Ross Stores specializes in affordable clothing and home furnishings, serving exclusively in the United States. Lately, it has gained popularity among households worried about their buying power and the impact of inflation.

The retailer operates two brands:

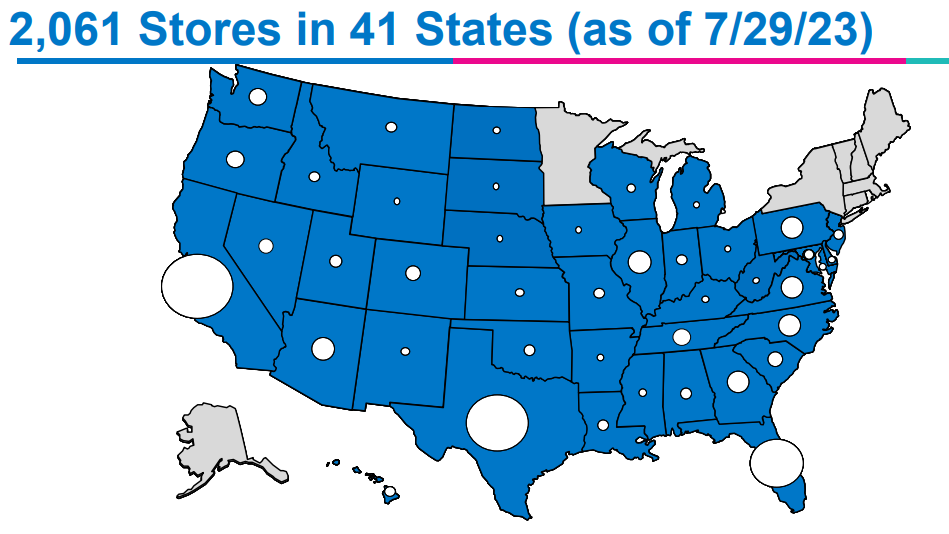

- Ross Dress for less focuses exclusively on clothing and home furnishings. The brand operates 1,722 stores in 40 states.

-

DD's Discounts focuses more on a diversified range including accessories, home furnishings, footwear and apparel. The chain operates 339 stores in 21 states.

Geographical distribution of group stores, Ross Dress for Less and DD's Discounts combined (source: Ross Stores)

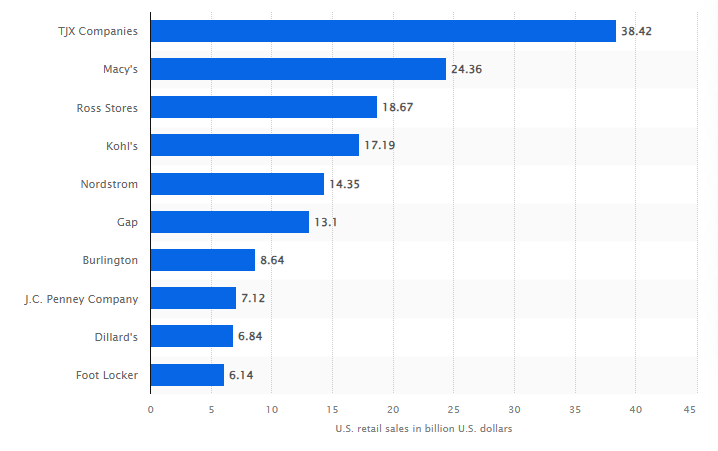

Ross Stores is the third-largest fashion and accessories retailer in the United States in terms of sales (source: Statista).

Ross Stores distinguishes itself through its business model focused on offering appealing prices, primarily catering to customers with modest to moderate incomes. In their stores, prices typically range from 20% to 70% lower than those in department and specialty stores. The majority of their stores are strategically situated in shopping malls near densely populated areas, ensuring excellent visibility and convenient access due to their location at busy intersections.

Ross Stores benefits from the consequences of rising prices

With a peak inflation rate of 9% in 2022, American households had to make tough choices about their spending. Those with lower incomes had no option but to opt for more affordable products. This consumption pattern is what drove Ross Stores to experience a remarkable sales increase of 50.9% in 2022 compared to 2021.

Furthermore, Ross Stores excels in building customer loyalty. On average, customers visit their stores two to three times a month. These stores are spacious, with an average area of 27,000 square meters, offering a wide range of products to meet customers' needs. This is precisely why the gradual decline of traditional department stores doesn't pose a significant risk to Ross Stores at this time. Customers delight in the in-store experience, akin to a "treasure hunt," where they can discover appealing offers during their shopping journeys. This dynamic is further fueled by the limited availability of certain items, prompting impulse purchases.

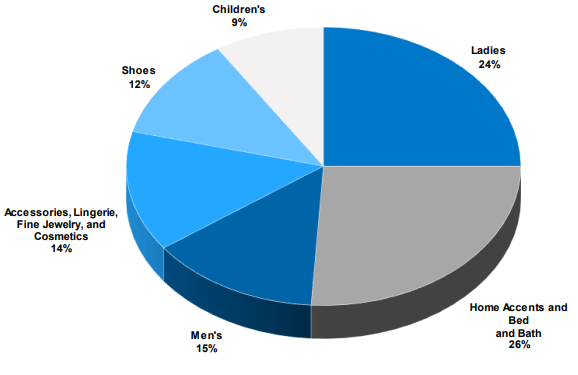

Ross Stores sales breakdown (source: Ross)

Ross Stores has effectively capitalized on inflation by offering affordable products, meeting the demand of cost-conscious customers. However, as inflation likely subsides, the company faces the challenge of managing increasing costs related to its purchases and expenses without passing them on to customers. Fortunately, the company's adept management has demonstrated its ability to navigate this situation. Over the past two financial years (2022 and 2023, ending in February), the company's margins have only experienced slight declines. This reflects efficient supply management, effective contract negotiations, and overall excellent control of operational costs. The company's business model, with its rapid inventory turnover and bulk purchasing, enables substantial economies of scale. Additionally, the costs associated with opening new stores are reasonable.

Nonetheless, it's crucial to monitor the situation closely. A recession in 2024 could potentially lead American consumers to reduce spending altogether rather than seeking out low-cost retailers. Notably, the Consumer Sentiment Index in the US remains historically low, even though it has improved since its low point in mid-2022. While the company has raised its earnings forecasts for the year, most of the growth will come from new store openings, reflecting American consumers' reluctance to increase their spending. Ross Stores is targeting sales growth between 2% and 3%.

Territorial expansion as the main source of growth

The company's primary concern is its heavy reliance on opening new stores for growth, a risk commonly associated with large retailers. We've previously highlighted this aspect in our analyses of other retailers, such as Academy Sports and Outdoors and Dollarama. In June and July, Ross Stores launched 18 Ross Dress for Less stores and 9 DD's Discounts.

To address this challenge, the company is predominantly banking on rapid product turnover and customer loyalty to fuel growth in its existing stores. Innovation is pivotal, considering a significant portion of sales arises from impromptu purchasing decisions by customers. As a result, the primary goal is to engage and entice customers during each store visit by introducing new items, and encouraging repeat visits.

Remarkable financial health

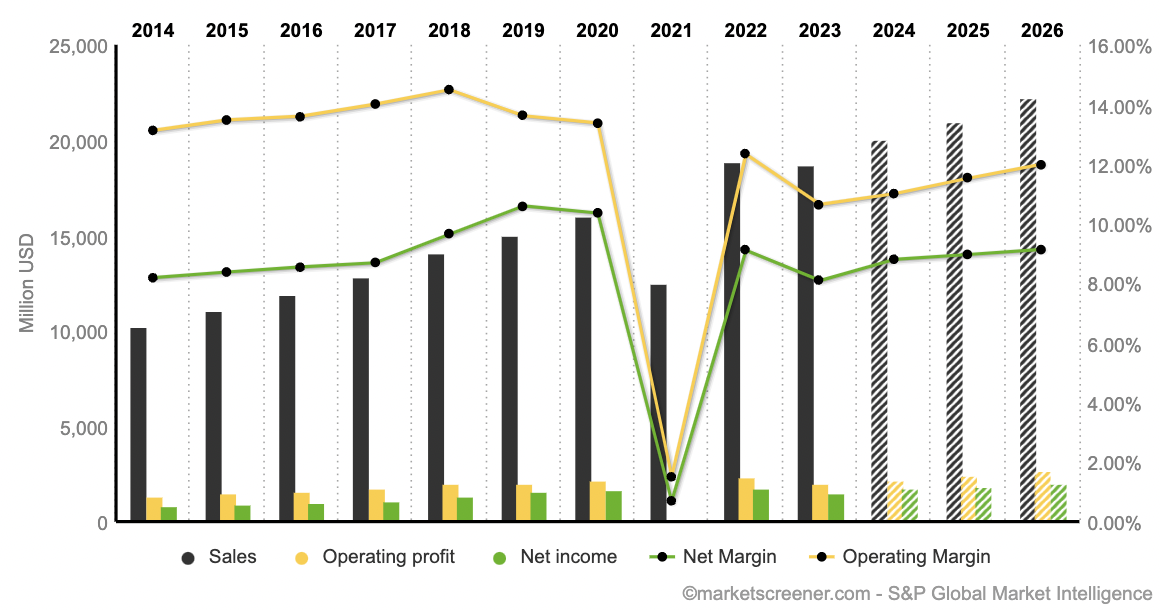

From a financial standpoint, the trajectory is quite impressive, except for the incident in 2021, which is effectively the same as 2020 due to the shift in the results publication date. The average annual growth rate over the past decade stands at 7%. Nevertheless, the Group is facing challenges in regaining its pre-pandemic profitability levels. As mentioned earlier, maintaining satisfactory margins is difficult given the limited room for maneuver.

Pre-pandemic profitability levels have yet to be restored (source: MarketScreener)

One notable factor is the significant increase in earnings per share over the past two financial years, more than doubling compared to 2014 and 2015 levels. This substantial rise can be attributed partly to profit growth during this period and partly to a decrease in the number of shares outstanding, resulting from various share buyback programs. From 2013 to 2023, the number of shares has decreased significantly from 429.8 million to 344.4 million, representing a substantial 24.8% reduction.

However, the Group has room for improvement in terms of free cash flow. Overall, free cash flow growth has lagged behind other metrics. The FCF margin was lower in the previous year compared to previous years, primarily due to a slower inventory turnover. This slowdown, while not inherently negative, reflects the Group's efforts to secure its supplies.

Ross Stores clearly dominates the competition

Ross Stores stands out as the dominant player in the U.S. retail sector. Its consistent quality in reporting and an aggressive expansion strategy keeps it ahead of the competition. In comparison, The TJX Companies, its primary competitor, falls short, particularly in profitability. Given that Ross Stores is half the size in terms of sales, it holds greater potential for improvement, as size plays a crucial role in achieving economies of scale in this business model.

When examining key valuation indicators, Ross Stores currently trades close to its historical average. This can be easily explained: while post-pandemic growth has been robust, profitability has slightly dipped. In summary, the case for Ross Stores remains strong, and a decline in its share price could present a valuable opportunity.

By

By