The company operates through four segments: the Construction Products Group (36% of net sales), the Performance Coatings Group (18% of net sales), the Consumer Group (35% of net sales), and the Specialty Products Group (11% of net sales). The Construction Products Group is involved in the production of sealants, adhesives, roofing and flooring systems, and waterproofing solutions. The Performance Coatings Group focuses on high-performance coatings, sealants, and adhesives for construction and industrial markets. The Specialty Products Group engages in the manufacturing of industrial cleaners, restoration services, and specialty chemicals. Lastly, the Consumer Group produces consumer products like paint, coatings, and caulks for both DIY and professional markets.

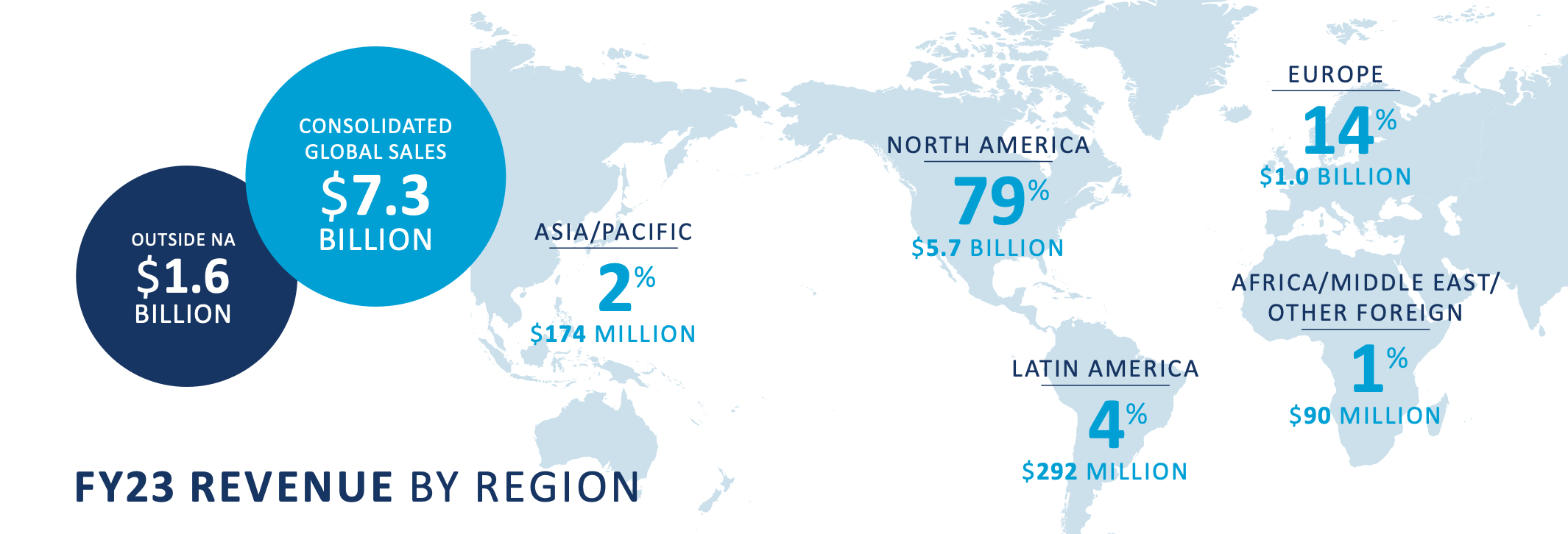

RPM, operating in 164 countries with 17,300 employees globally, prioritizes sustainability, employing strategies like renewable energy use and waste reduction. In 2023, it achieved $7.3B in sales, predominantly in the US (79%). Europe follows at 14%, with Asia/Pacific, Latin America, and Africa/Middle East/Other Foreign contributing 7%. Given the robust US presence, international expansion appears to be the upcoming growth catalyst. The Group aims for $8.5B in revenues, 42% Gross Margin, and a 16% Adjusted EBIT margin by 2025.

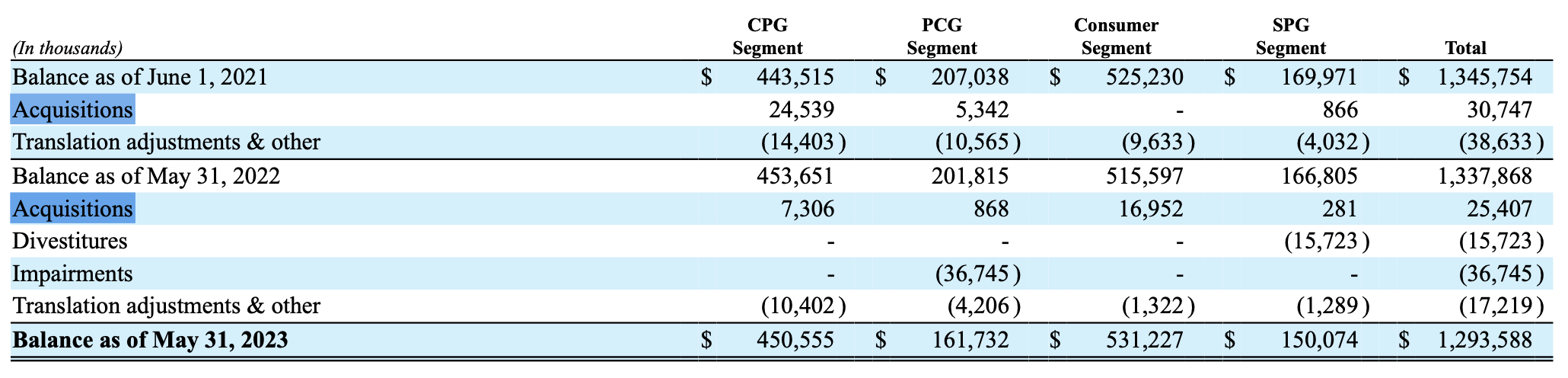

In the past 30 years, RPM International has executed 175 acquisitions, with 60 in the last decade. In 2022, eight acquisitions were made, aligning with their strategy to enhance the core business model, expand globally, and elevate brand recognition. A notable acquisition was Pure Air Control Services, strengthening vertical integration in the building supplies segment by enabling HVAC system installation and inspection. This move aligns with RPM's goal of providing comprehensive solutions to customers.

These acquisitions, including Pure Air Control Services, serve as a strategic response to potential declines in the housing sector. By utilizing robust free cash flow, RPM acquires companies during downturns, integrating them to bolster the construction segment and drive sustained long-term growth.

Key brands for the company include Rust-Oleum (small-project paint), DAP (residential caulk and sealant), Varathane (wood stains and finishes), and Zinsser (specialty primers, sealers, and wallcovering sundries).

While the company has a history of successful acquisitions, a slowdown in acquisition activity due to limited options, coupled with a focus on innovating existing segments using free cash flow (FCF), could result in prolonged growth stagnation. Additionally, potential macroeconomic headwinds and the recent downturn in the housing market may pose challenges for construction projects, impacting the overall success of the company.

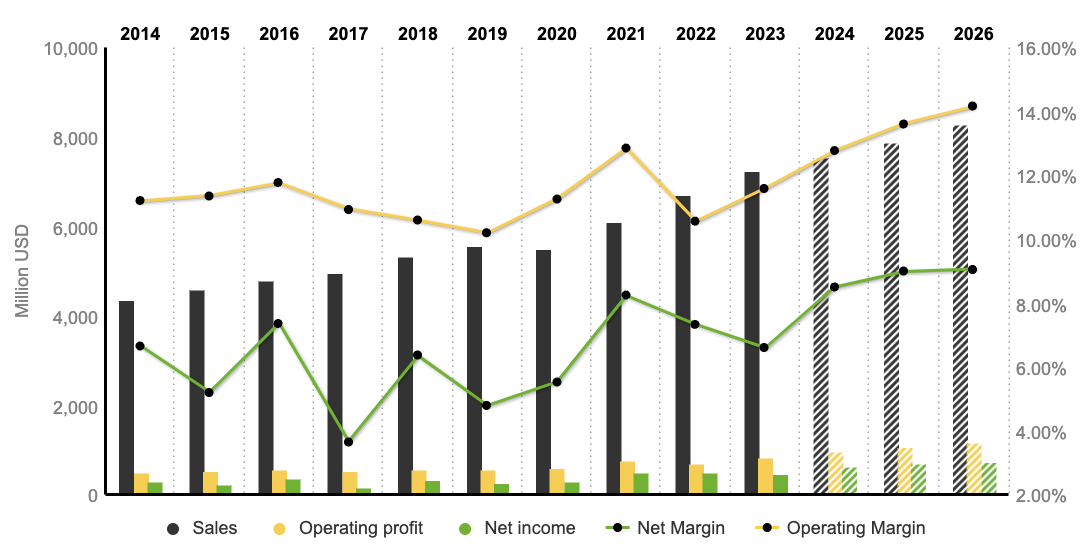

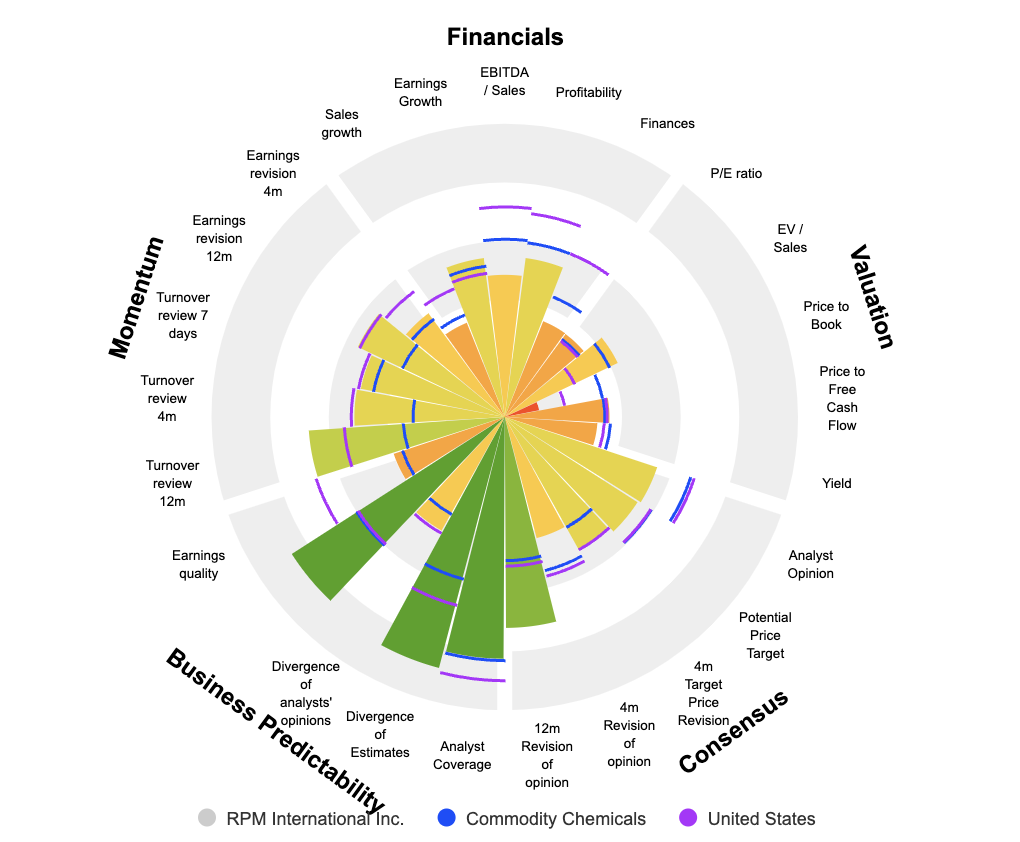

From an operational standpoint, the manufacturer has displayed good performance, with EBITDA and EBIT recording a CAGR of 6% and 6.5%, respectively, since 2017, while maintaining operating margins around 11%. Analysts anticipate a 35% increase in EBITDA to $1.35 billion by 2026, with operating margins projected to reach approximately 14%. The return on assets (ROA) has fluctuated between 6% and 8% since 2014 (excluding 2020), but it is expected to reach 10% in 2026. Similarly, the return on equity (ROE) has followed a similar trajectory as the ROA and is expected to reach 28% in 2025. It is noteworthy that RPM International has been profitable for more than 50 years and has paid dividends every year since 1973. It's among the select "dividend kings," with a total shareholder return of nearly 115,000% through reinvesting dividends, excluding taxes, and maintaining a CAGR over 15%.

In the first quarter of 2024, it has reported solid revenues and net income, with net sales of $2.012 billion (a growth of 4% YoY), EBITDA of $353 million (a growth of 12.4% YoY), an operating margin of 15.4% (a growth of 8.45% YoY), and a net income (YoY +18.9%) to $201 million ($1.57 per diluted share).

RPM International is a robust company poised for growth in current segments and new geographic areas. Its market position and attractive dividend make it an enticing opportunity for investors to monitor. However, it's worth noting that over the past 5 years, the company has outperformed its benchmark, the S&P 500, by only 5.5%, potentially reflecting higher associated risks.

By

By