Tetra Tech is a U.S.-based consulting and engineering services company focused on water, the environment, sustainable infrastructure and renewable energy. With over 50 years' experience, the group has completed 100,000 projects in more than 100 countries by 2022. It is valued around $9 billion.

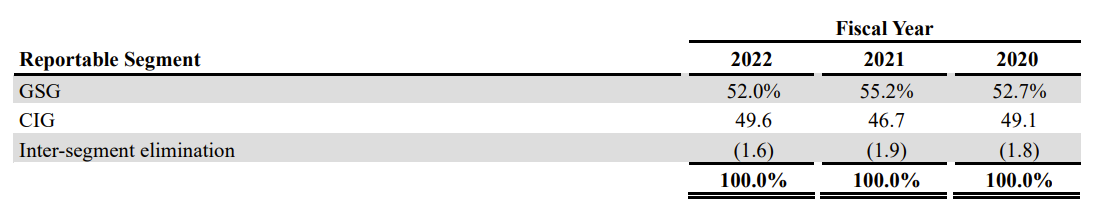

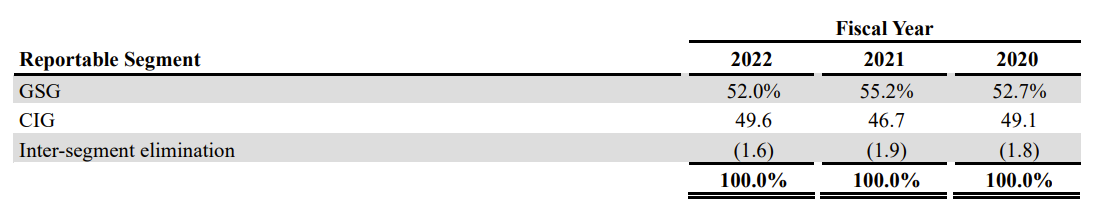

The Government Services Group (GSG), which accounts for 52% of sales, serves U.S. federal, state and local governments, as well as development agencies worldwide, particularly in Australia and the UK. Tetra Tech provides consulting and engineering services in the aforementioned fields and in disaster management.

The Commercial/International Services Group (CIG), which accounts for 49.6% of revenues, serves a diverse range of customers, including Fortune 500 companies, the renewable energy and aerospace industries, in Canada, the Asia-Pacific region (Australia and New Zealand), the United Kingdom, Brazil and Chile.

In 2022, Tetra Tech made its biggest acquisition since the company's foundation: it acquired its small British rival RPS Group for around $800 million. This purchase is part of a strategy to increase its presence in Europe and become the world leader in the sector. In the first quarter, the Group posted record sales of over $1 billion, thanks in part to the acquisition of RPS Group.

Source: Tetra Tech Annual Report

Narrow customer base, targeted geography, strong seasonality

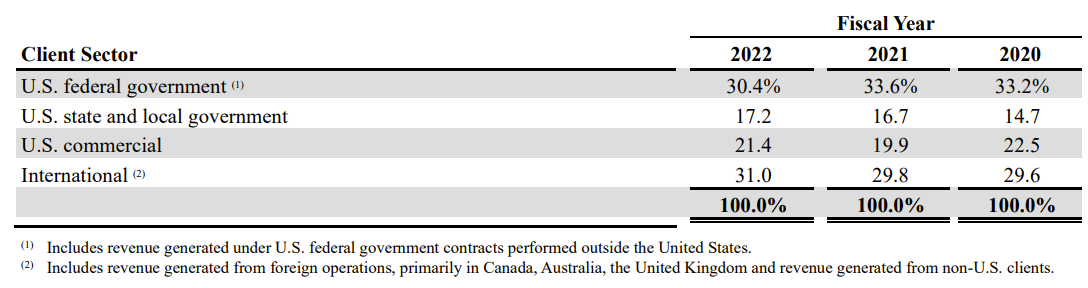

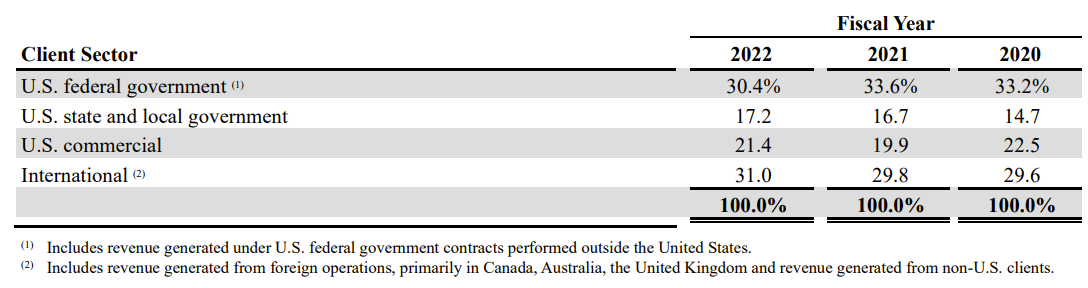

U.S. federal government agencies are the Group's biggest customer. The United States Agency for International Development (USAID) accounted for 11% of sales in 2022, and the Department of Defense (DoD) for 9.7%. No individual customer accounts for more than 10% of the company's revenues.

Source: Tetra Tech Annual Report

U.S. customers generated 68% of sales last year. The remaining 32% was generated internationally, mainly in Canada, Australia and the UK.

Tetra Tech's sales are usually lower in the first half of its fiscal year, mainly due to the Thanksgiving (in the USA and Canada), Christmas and New Year vacations. In addition, weather conditions sometimes lead to the temporary closure of offices or hamper work in the field. These situations lead to a reduction in the number of billable hours on projects and, consequently, to lower sales.

Management

Danny Batrack, CEO, has been at the helm of the company since 2005. He joined Tetra Tech in the 80s as an oceanographer and then Arctic researcher. He knows the company's challenges inside out, as do the rest of the management team, most of whom have been with the company for over a decade.

Financial performance

Tetra tech has posted an average annual growth rate of 8.7% over the past six years. The company has forecast sales of $3.5 billion in 2022, a price/earnings ratio (P/E) of 31.9x and an enterprise value/EBITDA (EV/EBITDA) of 21.6x. Forecasts predict sales of $4.2 billion by 2025.

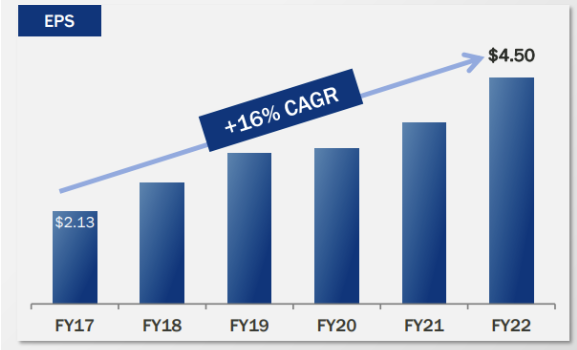

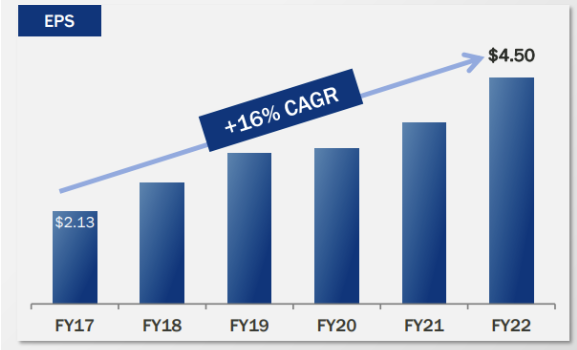

Among its strengths, the company's net margin is the highest in the industry, at 9.3% last year. Forecasts predict a net margin of 8.5% for 2025, with analysts estimating that the acquisition of RPS Group will erode margins by 1.5 points. Return on equity (ROE) will reach 21.8% in 2022. Earnings per share are rising steadily, with a CAGR of 16% over the last five years.

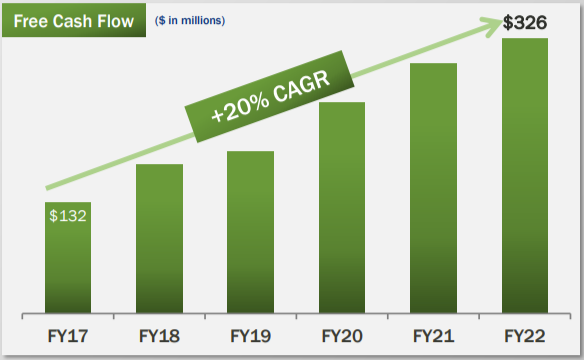

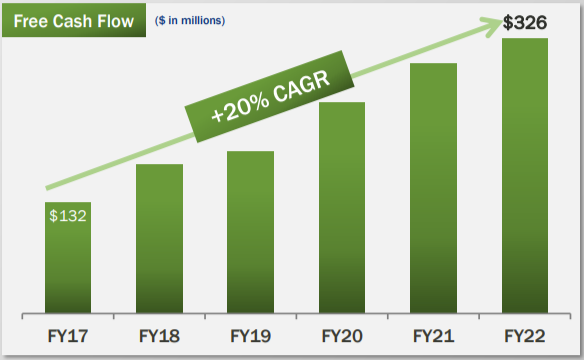

The company holds $258 million in borrowings at a rate of 1.97% maturing in 2027, which remains minimal, and its debt leverage is 0.76x, meaning that debt represents only 76% of the company's equity. Tetra Tech has a strong Free Cash Flow generation reaching 11.3% margin in 2022, with a CAGR of 20% over the last five years.

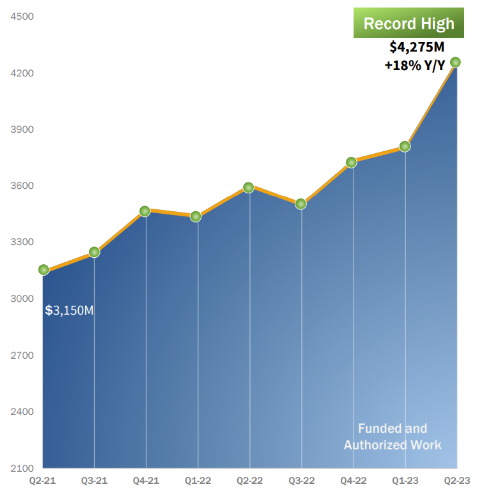

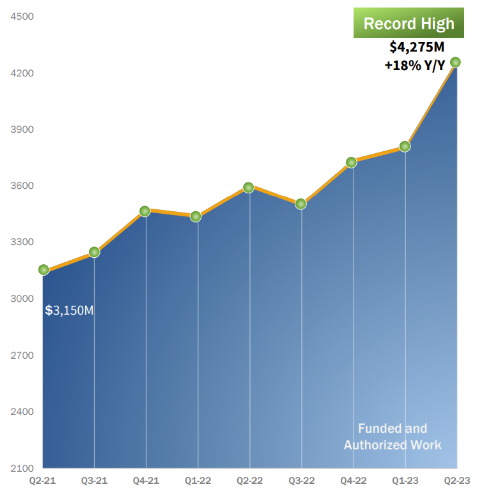

The Group's order book reached a record level of $4.275 billion, up 18% on the previous year. This high level provides greater visibility on future revenues and underlines solid growth in the consulting and engineering industry.

Tetra Tech is therefore a thriving company, benefiting from a diversified range of activities in the environmental and water sectors, and continuing to expand its position among industry leaders. Its growth prospects are solid, stimulated by new contracts won as a result of growing global awareness of water and environmental issues.

.png)

By Paul Ferrier

By Paul Ferrier

.png)