Axon has demonstrated an ability to swiftly evolve and regularly launch improved products, a crucial factor in sustaining product growth. While TASER devices and cameras remain central, Axon's cloud-based SaaS offerings form the core of its business, creating a fully integrated ecosystem that positions the company for robust, market-leading growth in the foreseeable future. The company managed to innovate within a traditionally conservative and highly regulated industry, primarily serving local and state law enforcement tools and training, which inspires confidence in its long-term prospects. The integration of their ecosystem, combined with commitment to innovation in non-lethal weapons and sensor product lines, shapes a compelling growth narrative.

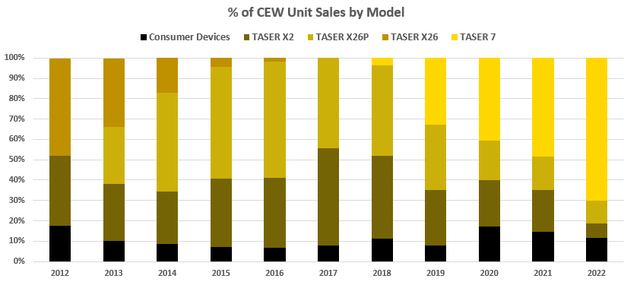

Axon's consistent product innovation is evident in the regular development and release of upgraded devices. In the hardware segment alone, the company introduced 10 new models since 2012, including 3 TASERs and 7 cameras. It stands out not only for the frequency of these launches but also for the remarkable speed at which these products gain market traction.

Since reporting unit sales in 2012, three CEW models—TASER X26P, TASER 7, and TASER 10—have been launched. The TASER X26P, introduced in May 2013, exceeded 100,000 units sold in less than 3 years, with a CAGR of 20%, reaching 502,118 units by EOY 2022. The TASER 7, launched in October 2018, achieved a remarkable 73% CAGR, totaling 362,000 units sold by EOY 2022. The TASER 10, unveiled in Q1 2023, is experiencing rapid adoption, with Q3 2023 revenue growing more than 50% sequentially. In Axon's own words, "We are pleased with our TASER 10 ramp—revenue grew more than 50% sequentially, demonstrating solid execution on this new product launch, and demand is exceeding our expectations." This swift adoption extends to the company's camera launches as well.

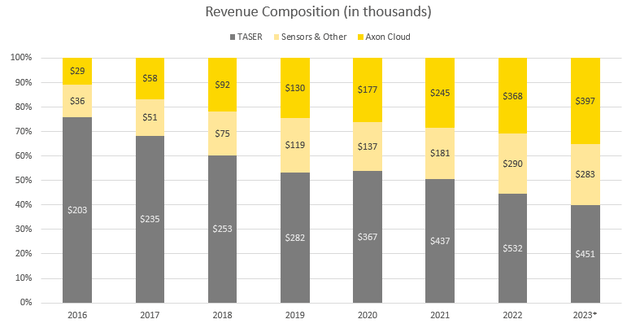

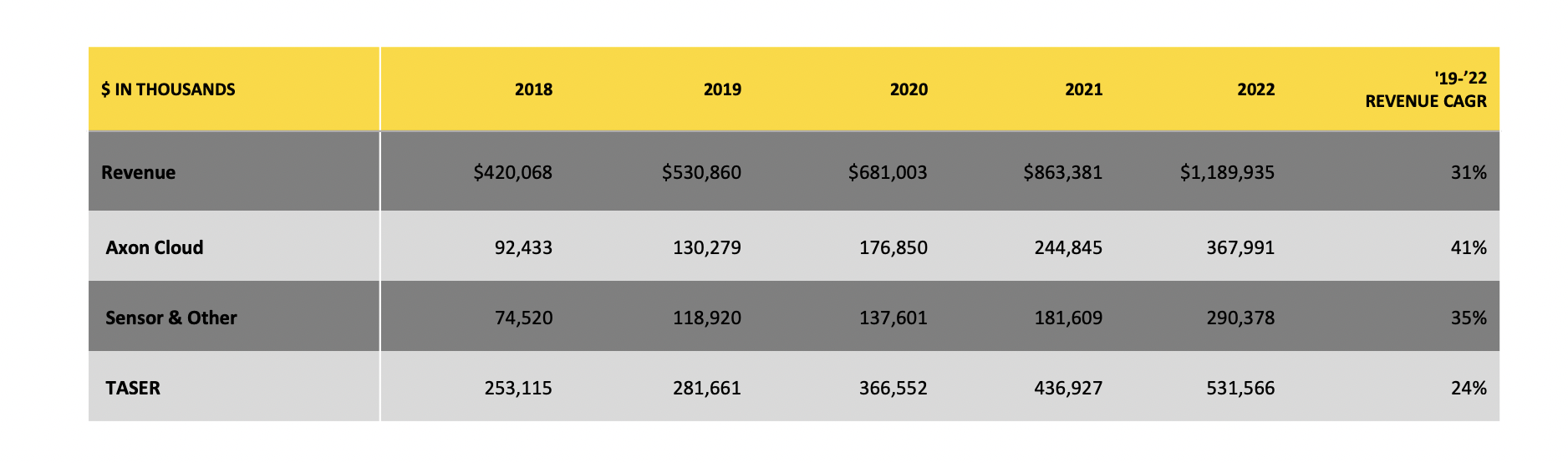

In its evolving business model, the integrated software serves as the foundation, marking a strategic shift from selling physical objects like TASERs to providing services through their Software as a Service (SaaS) offerings. This change has proven highly successful, with the cloud-based software segment growing from a modest 11% of total annual revenue in 2016 to over 35% by the first three quarters of 2023.

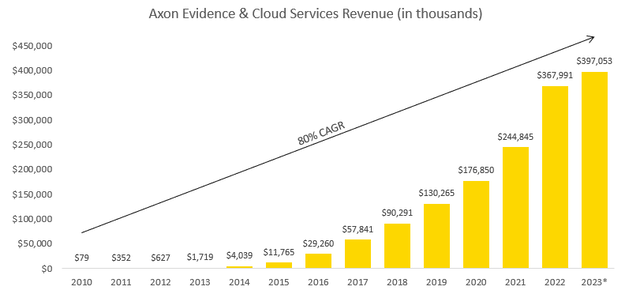

The entry into the cloud-based SaaS realm has been met with resounding success, evidenced by an impressive 80% CAGR in software revenue since its inception in 2010. Notably, as the fastest-growing segment, the software business boasts the highest margins. Over the past decade, Axon has elevated software gross margins from -10% in 2013 to a reputable 73% through the first three quarters of 2023, maintaining margins of at least 70% since 2019. Anchoring their business model around software has not only boosted profitability but has also created a recurring revenue stream, with SaaS Annual Recurring Revenue increasing nearly 10-fold over the last seven years, surging from $32 million in Q3 2016 to an impressive $619 million in Q3 2023.

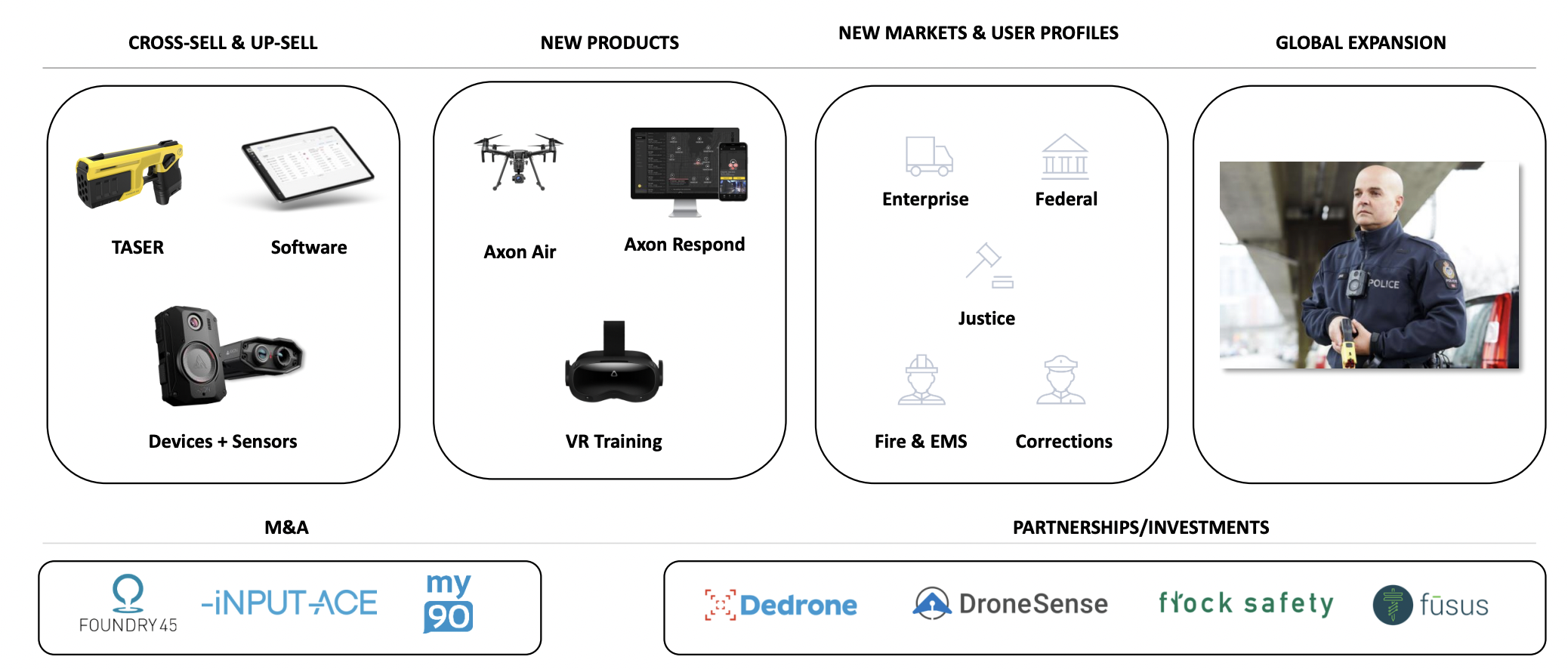

Axon is positioned for substantial growth through various avenues, including cross-selling and upselling, product diversification, new market entries, and international expansion. The company's commitment to innovation and continuous improvement creates opportunities for sustained revenue growth and consistent Net Revenue Retention (NRR). The introduction of new offerings such as Axon Air, Axon Respond, and enhanced Virtual Reality (VR) training technology expands the scope for growth. Notably, Axon's strategic approach to innovation not only supports cross-selling and upselling within its existing customer base but also introduces new products that cater to evolving market demands.

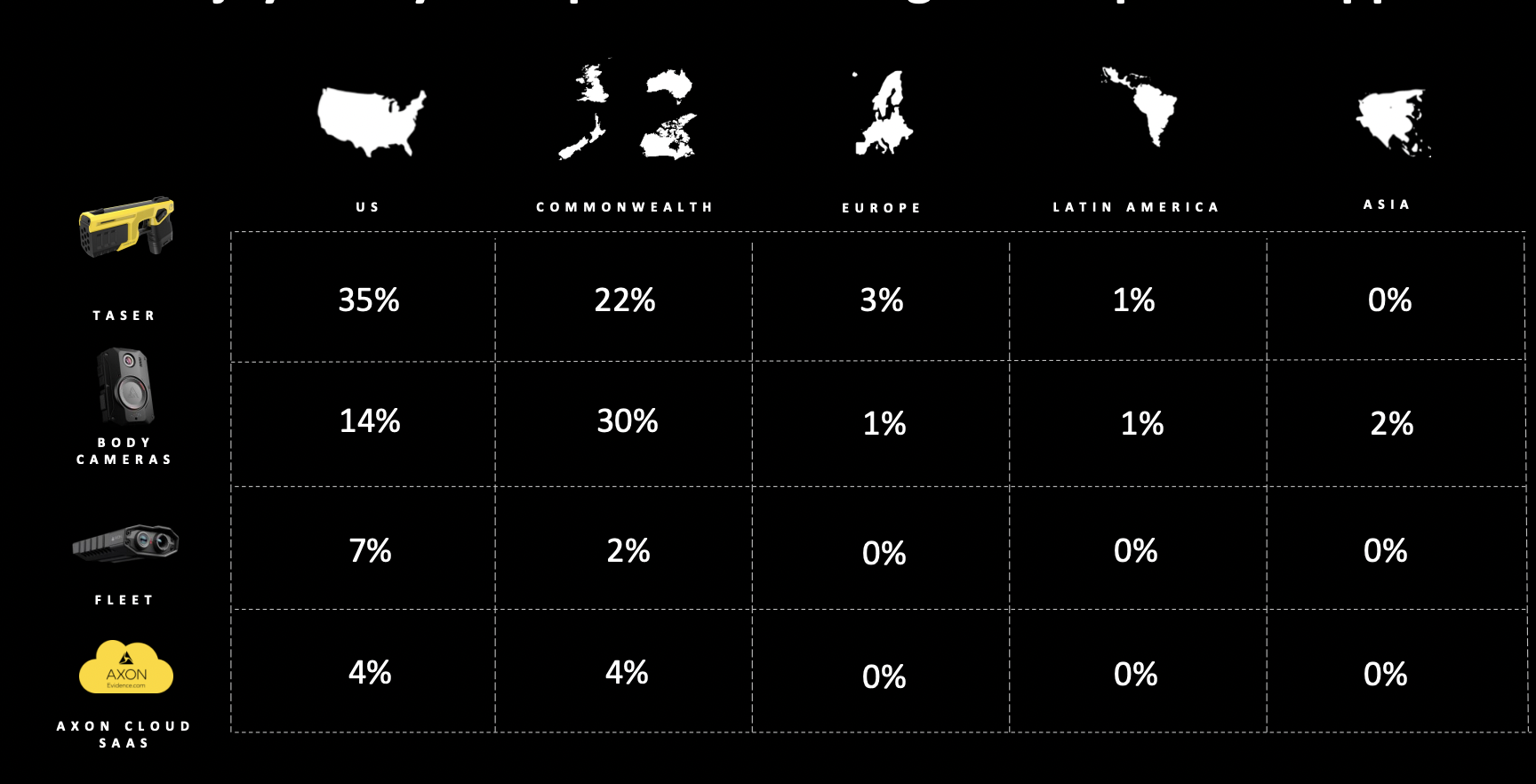

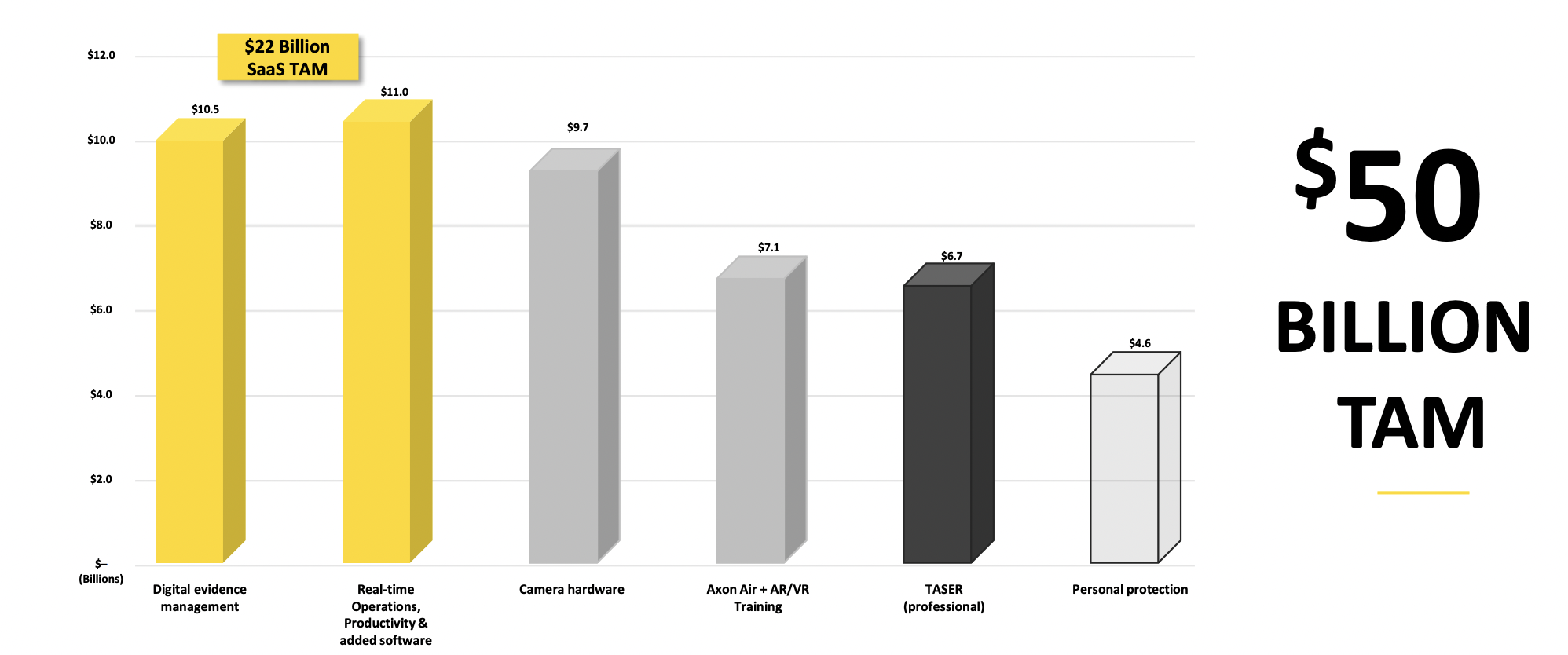

In addition to penetrating new target markets like the fire and EMS sector, Axon's expansion potential extends geographically. Despite its dominance in the U.S. CEW and body-worn cameras markets, the company has only captured 35% and 14%, respectively, indicating significant growth potential domestically. Furthermore, Axon's cloud-based SaaS products currently reach only 4% of their SaaS addressable market (TAM) in the U.S., leaving ample room for expansion. Internationally, Axon eyes untapped territories in European, Latin American, and Asian markets, where the company's SaaS business stands out as the fastest-growing and highest-margin segment. The current TAM of $50 billion underscores a vast untapped opportunity of $48.8 billion, showcasing the significant room for growth in Axon's strategic approach to innovation and expansion efforts.

Axon Enterprise, while presenting substantial growth opportunities, navigates inherent risks in its operations. In the competitive landscape, the company contends with formidable rivals like Motorola Solutions, International Business Machines, Oracle, Tyler Technologies, Northrop Grumman, and Hitach, all of which, being larger and well-capitalized, pose a persistent threat by potentially diverting customers through more robust investments in innovative solutions.

The company leverages partnerships with both U.S. state and federal entities to attain target revenues. Beyond government collaborations, the expansion into the commercial sector is a key strategic objective for the company.

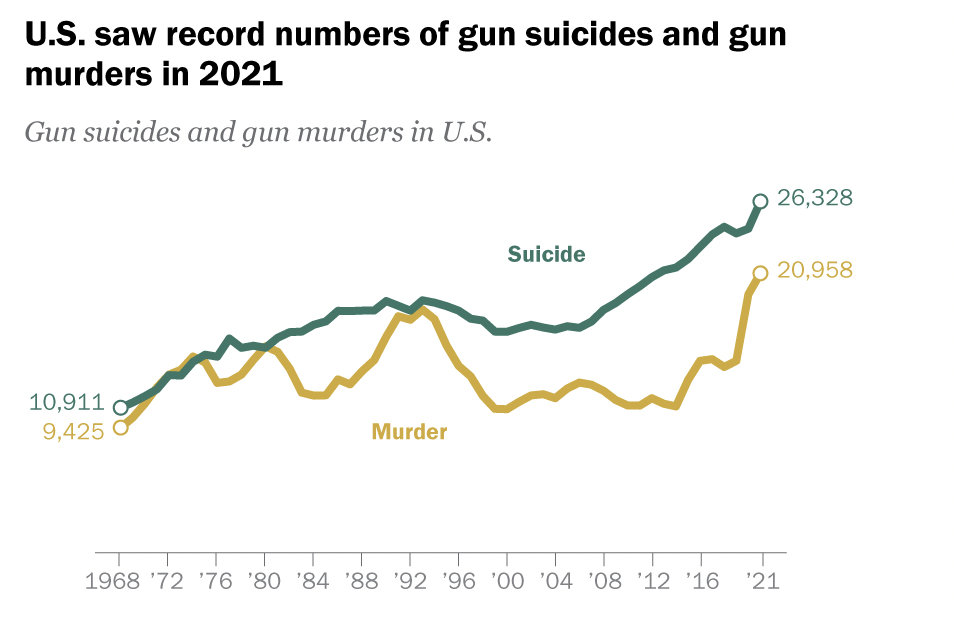

The United States faces a substantial issue with the increasing prevalence of firearms, correlating with a rise in both homicides and suicides. This trend emphasizes the immediate need for viable solutions to address the impact of guns on public safety. In response to these challenges, companies like Axon propose alternatives aimed at improving law enforcement capabilities through innovative technologies. Axon's emphasis on offering non-lethal solutions, including TASER devices and body-worn cameras, is positioned as an approach to navigate the complexities associated with incidents involving firearms.

Beyond the competitive challenge, Axon faces regulatory risks linked to changes in legislation governing law enforcement technology. Shifts in general legislation, data access policies, ethical guidelines, use of force protocols, and legal liability statutes could necessitate significant capital investment for compliance, diverting resources from product development. This regulatory landscape is complicated by the looming threat of direct litigation, especially regarding product liability cases linked to Axon's TASER devices. Heightened privacy concerns may lead to allegations of privacy rights violations against Axon's camera and evidence platform, adding another layer of legal risk. The potential for a cyberattack targeting Axon's cloud-based Evidence platform poses a critical risk, potentially tarnishing Axon's reputation and prompting customer defection to competitors.

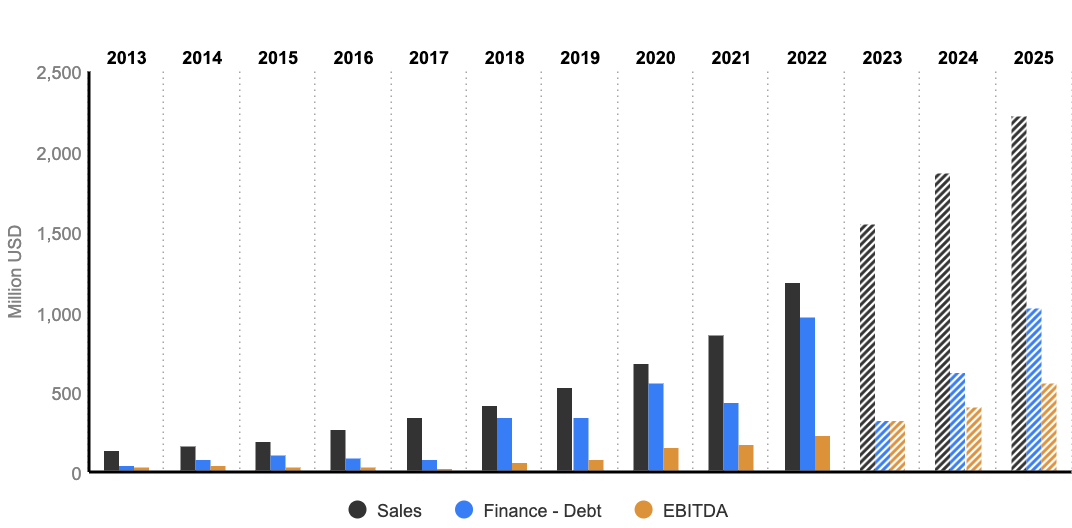

In 2022, Axon has delivered record revenue growth of 38% to $1.19 billion (target of $2B for 2025) and net income of $147 million (12.4% net income margin), supporting Adjusted EBITDA of $232 million, or 19.5% Adjusted EBITDA margin. Axon Cloud software business grew 50% in 2022 on top of 38% growth the year before, and made up an increasing share of the business. Axon Cloud revenue of $368 million represented 31% of total revenue, and drove 45% Annual Recurring Revenue growth to $473 million.

In the projection for 2025, the company anticipates a Free Cash Flow (FCF) growth to $400 million, with net income approaching $300 million and Earnings Per Share (EPS) reaching $3.85. This represents a substantial increase of 90% compared to the figures reported in 2022.

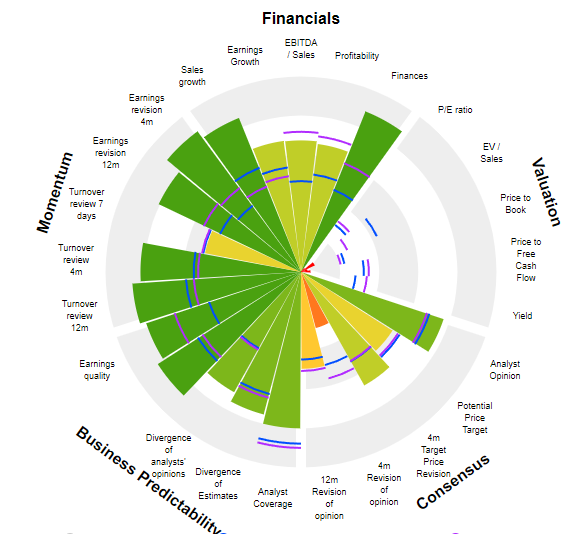

It has experienced a substantial growth in market capitalization, witnessing a 742% increase from $1.4 billion in 2017 to $11.8 billion in 2022. This remarkable surge, coupled with strong financial performance, has generated considerable attention and heightened expectations for the company. However, this heightened investor optimism is reflected in the stock's high valuation, with a Price/Earnings (P/E) ratio reaching 81.7x for the year 2022. The notable increase in market capitalization, while indicative of positive market sentiment, raises concerns about the company being potentially overvalued relative to its earnings.

Axon's resilience and innovation in the public safety industry, evidenced by the regular launch of upgraded TASER and camera models, position the company for significant growth. The success of their SaaS business, driven by the digital evidence management platform, has led to substantial revenue expansion and a strategic shift toward a successful subscription-based model. With recurring revenue growth and Net Revenue Retention consistently exceeding 120%, Axon's integrated ecosystem and potential international expansion further underscore its positive trajectory.

By

By