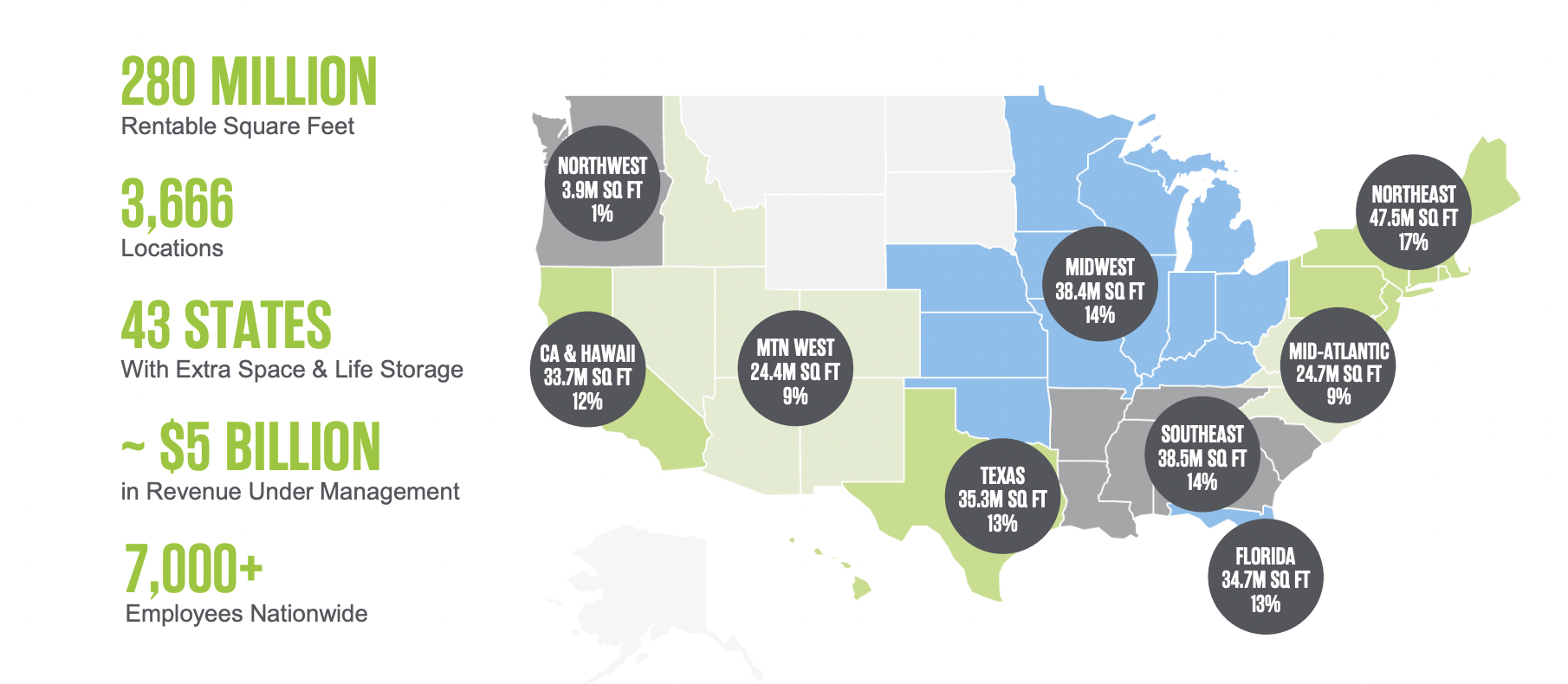

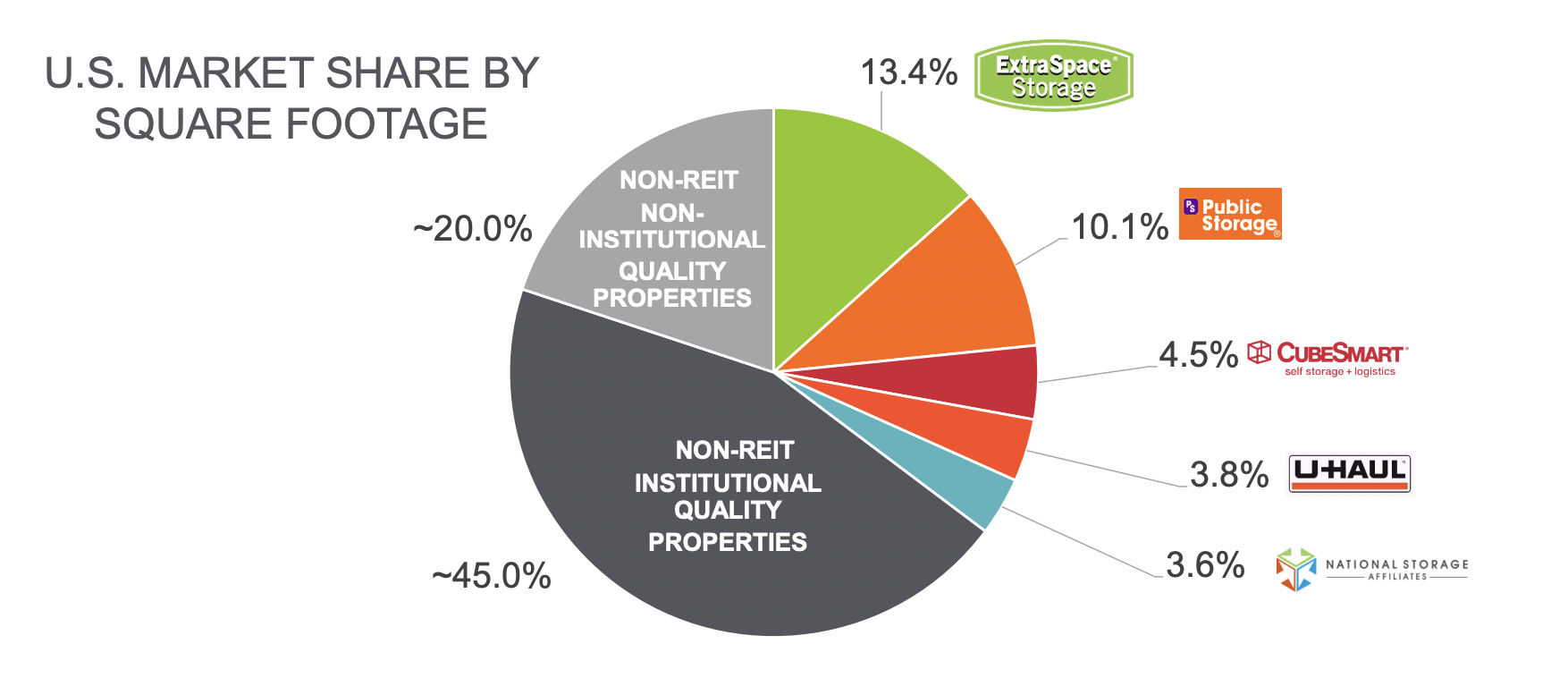

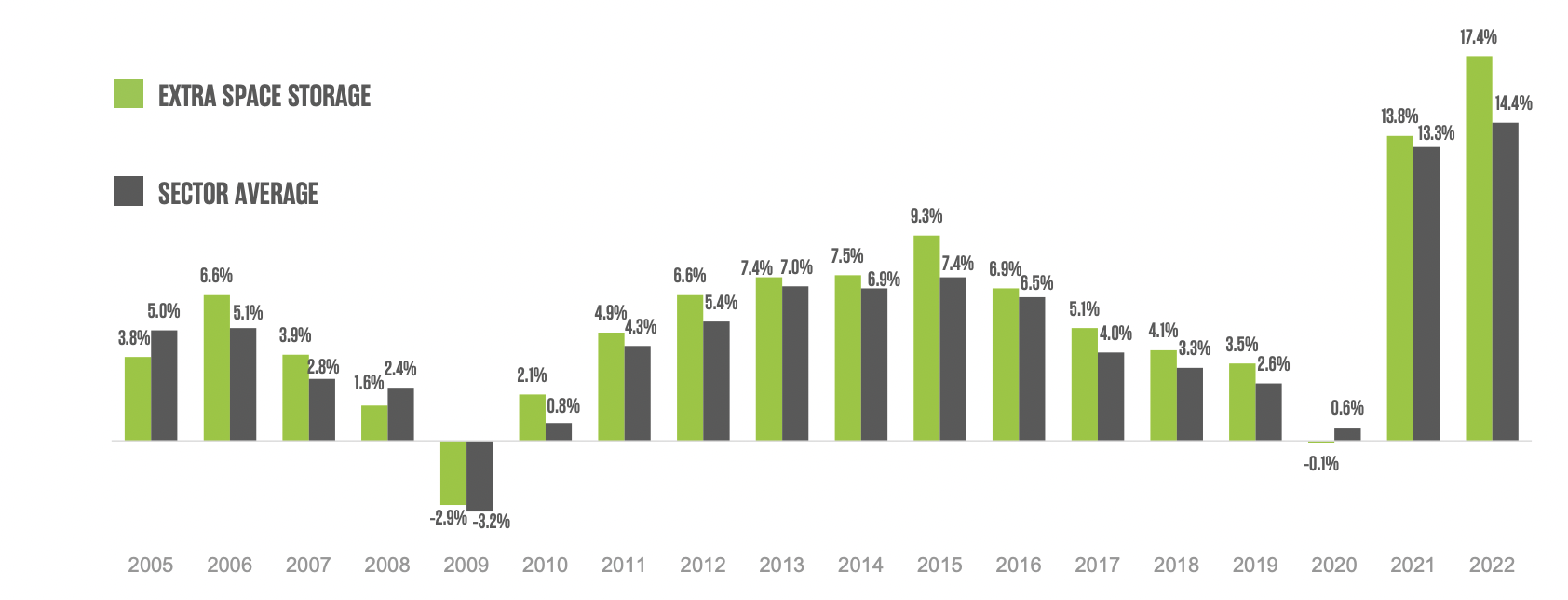

One of Extra Space Storage's most appealing attributes is its impressive diversification, with operations spanning across most of the country, providing the company with a substantial market share. The broader US self-storage REIT industry displays a promising long-term growth outlook driven by secular trends. Rising housing prices since 2010 have led households to seek economical ways to maximize their living space, boosting demand for self-storage services. These companies wield significant pricing power, evident in their operating margin exceeding 60% and net margin over 50%. This robust pricing power stems from the logistical challenges households face in relocating their stored items and the high historical occupancy rates of self-storage properties, supported by population growth and housing price increases. Considering that self-storage costs represent a small portion of the average household budget, companies like Extra Space Storage can implement meaningful rental rate increases more easily than other sectors, making them financially resilient in dynamic market conditions.

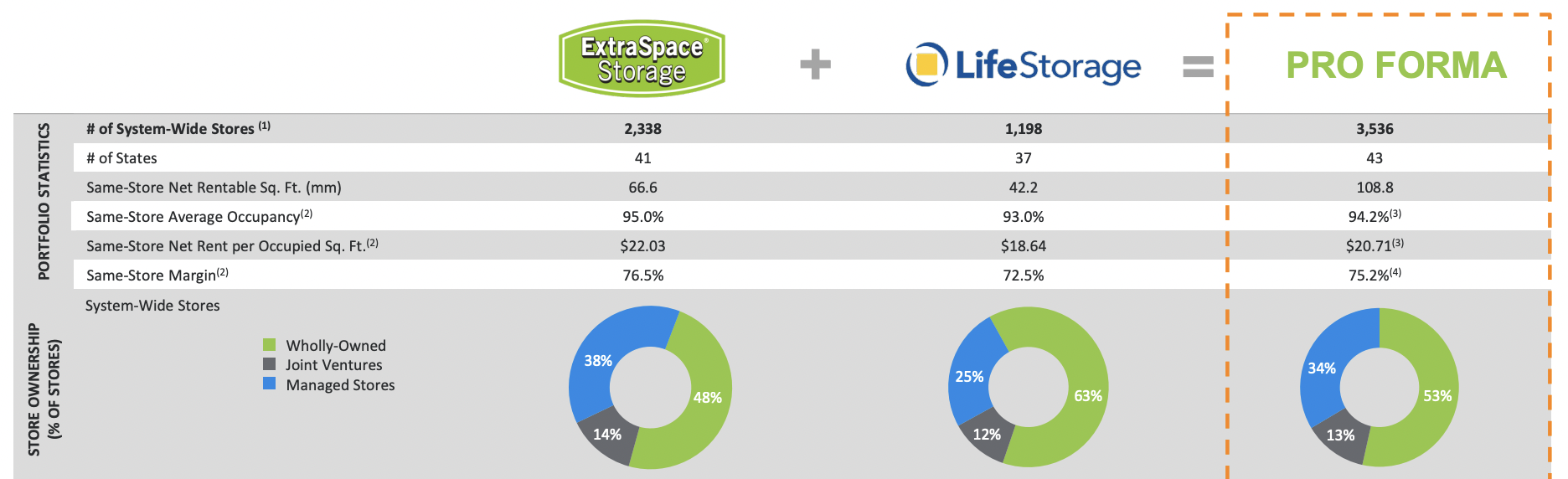

Last April, Extra Space Storage made a significant strategic move by merging with Life Storage, a self-managed equity REIT based in Buffalo, New York. Life Storage operates more than 1,150 storage facilities across 37 states and the District of Columbia, catering to both residential and commercial customers with monthly rental storage units. With a customer base of over 675,000, Life Storage has established itself as a leader in the industry.

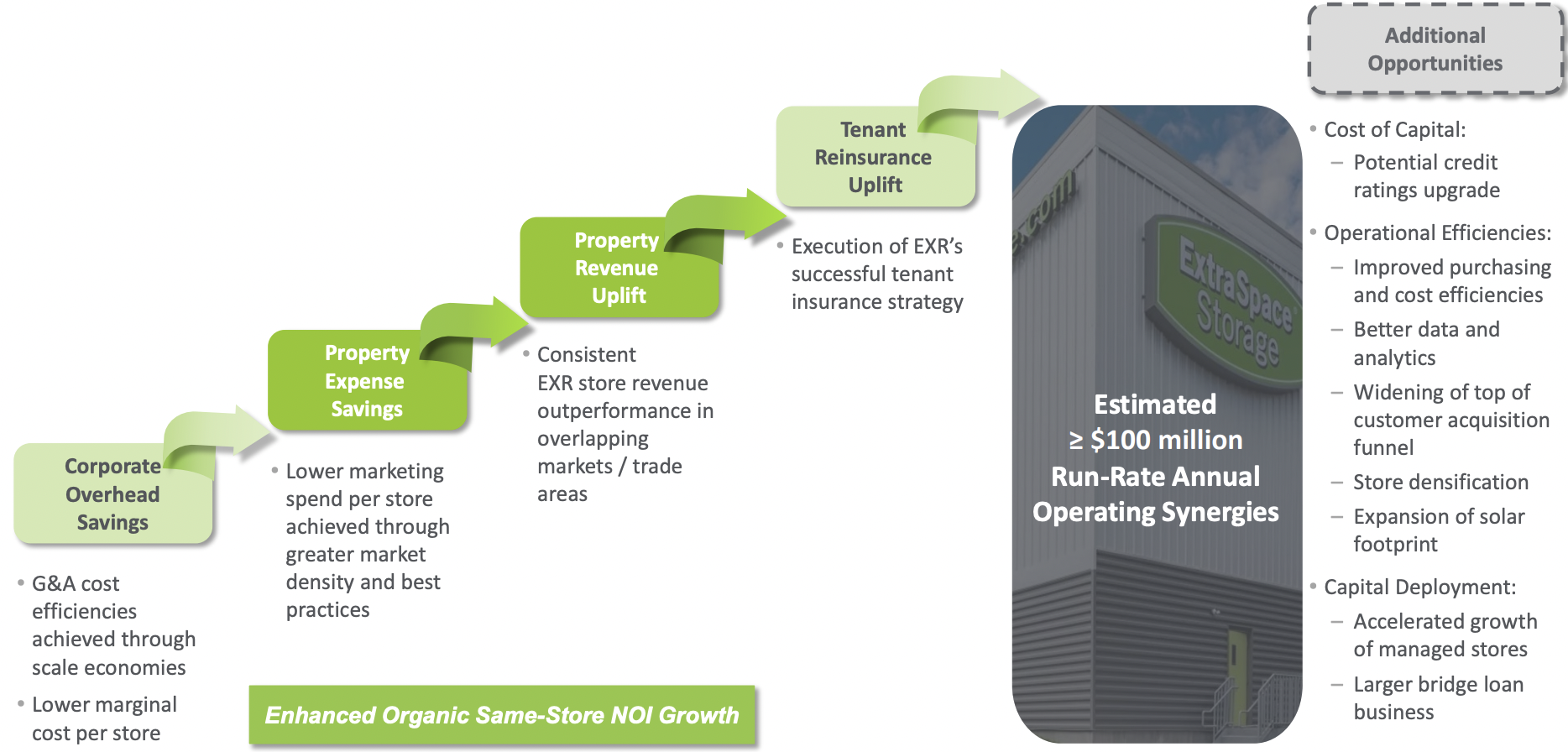

This strategic merger substantially expanded Extra Space Storage's portfolio by over 50% in terms of store count. The addition of Life Storage's 1,198 properties, comprising 758 wholly-owned, 141 joint venture, and 299 third-party managed stores, contributed more than 88 million square feet to Extra Space Storage's portfolio. Consequently, the combined entity now operates the largest storage operation in the country, boasting over 3,500 locations, 264 million square feet, and serving over two million customers. Notably, the merger is expected to yield significant cost savings, with estimated savings exceeding $100 million through tenant reinsurance uplift and reductions in property expenses.

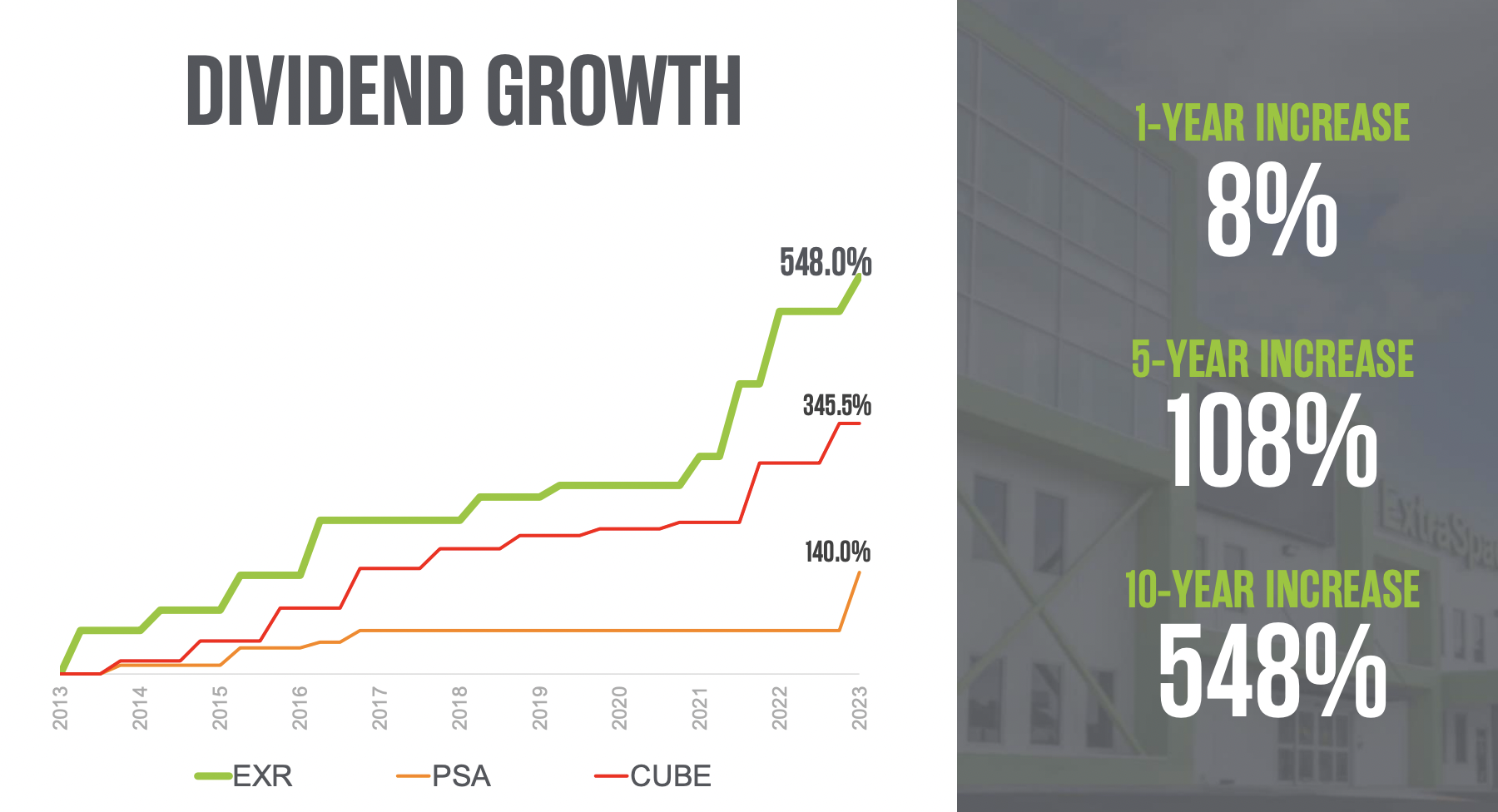

The dividend payout is a crucial aspect of Extra Space Storage's financial strategy. Over the period from 2004 to 2022, the dividend has seen remarkable growth, escalating from $0.3388 to $6, reflecting a substantial 1670% increase. However, the acquisition of Life Storage has impacted the company's income statement, leading to a halt in the trend of increasing dividends, with the dividend amounting to $4.86 for the 2023 financial year.

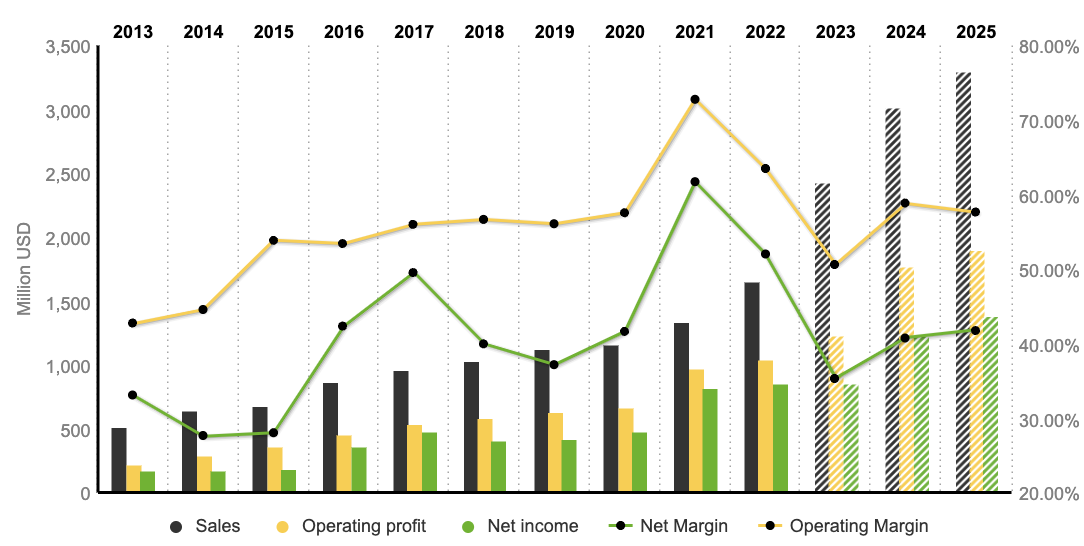

Examining the recent performance of the REIT provides valuable insights into its growth trajectory. In the last quarter, Extra Space Storage generated $440.7 million in rental revenue, demonstrating a notable year-over-year increase from $408 million. This surge in rental revenue signifies enhanced profitability in its rental operations. The annualized figure for the last quarter reached $1.76 billion, surpassing the past 3-year average of $1.38 billion, indicating a positive growth trend.

However, it's important to note that this growth did not translate directly to operating income, which was slightly lower during the second quarter compared to the previous year; $273.3 million versus $275.6 million. When annualized, the operating income for the last quarter amounted to $1.09 billion, which is higher than the 3-year average of $897.4 million, reflecting a robust operational performance despite the quarterly dip.

A similar pattern emerges in funds from operations. Although the year-over-year quarterly figures were slightly lower at $296 million compared to $303.58 million, the annualized funds from operations reached $1.18 billion, surpassing the 3-year average of $965 million.

There are notable downside risks associated with the acquisition that warrant consideration. Firstly, there's a potential antitrust concern due to the creation of the largest self-storage property firm in the US. While the deal's estimated market share of ~13% might not immediately trigger regulatory suspicions, it's crucial to acknowledge the recent crackdown by the US Federal Trade Commission ('FTC') on large entity dealmaking, indicating a need for vigilance regarding increased regulatory scrutiny.

Moreover, a significant risk lies in the substantial net debt load that the combined entity will bear. Managing this enlarged debt burden becomes more challenging, especially when coupled with sizable total payout obligations. Diverting free cash flow to equity investors via dividends might impede deleveraging activities, impacting the company's financial flexibility. Although S&P's positive stance on the deal's impact on Extra Space Storage's credit rating is reassuring, rising interest rates in the US could exacerbate the challenge of handling the enlarged debt load, necessitating careful financial management strategies to mitigate potential adverse effects.

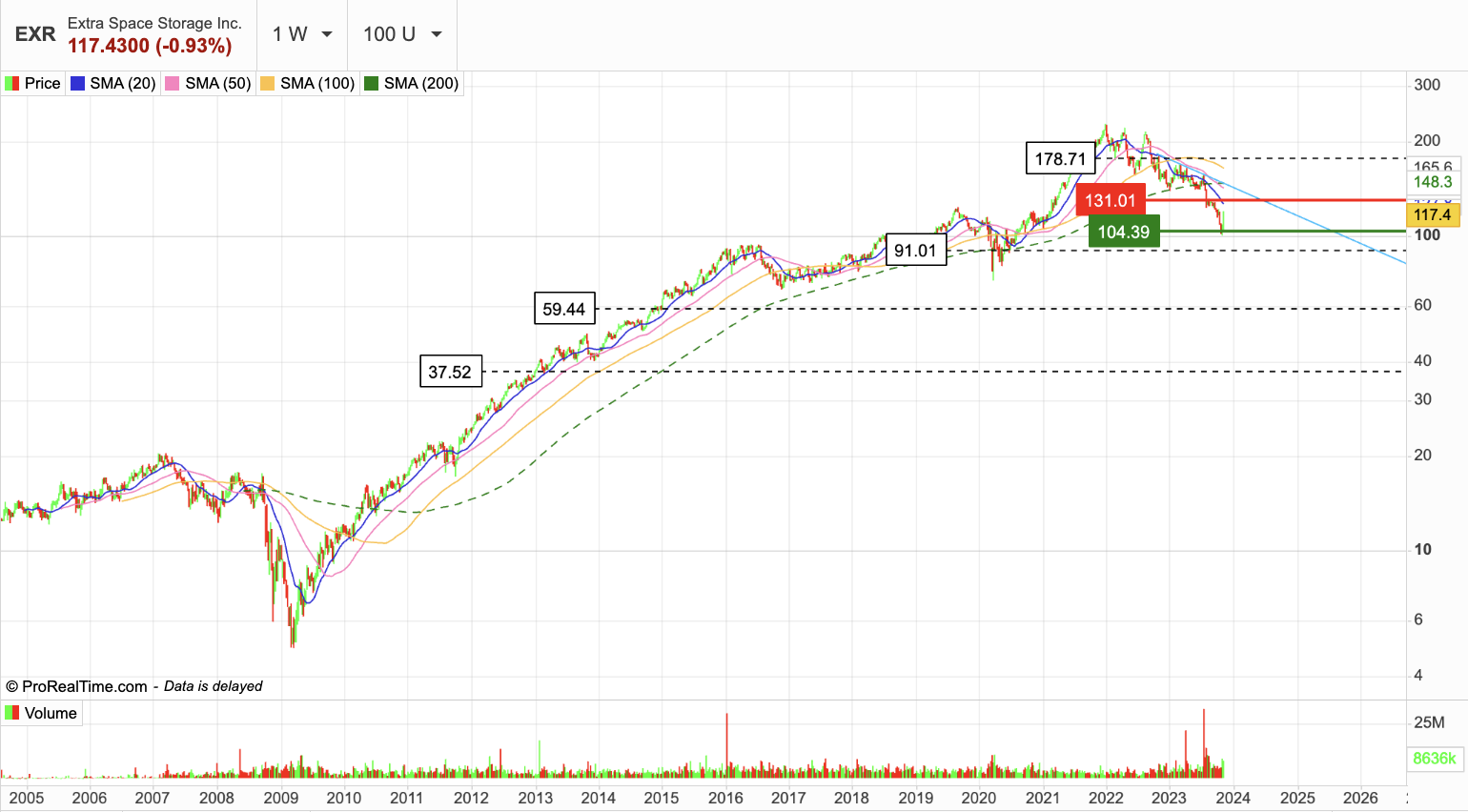

The current market scenario for Extra Space Storage (EXR) is a tale of both impressive growth and subsequent challenges. Trading at approximately $119, the share price has undergone significant fluctuations over the past decade. After a remarkable upward trajectory driven by favorable results and optimistic projections, the share price reached its peak at around $229 during the pandemic boom. However, this surge proved unsustainable, leading to a subsequent decline. Despite occasional consolidation phases, persistent selling pressure has resulted in a nearly 50% decline in price-performance terms, reaching this week's lows.

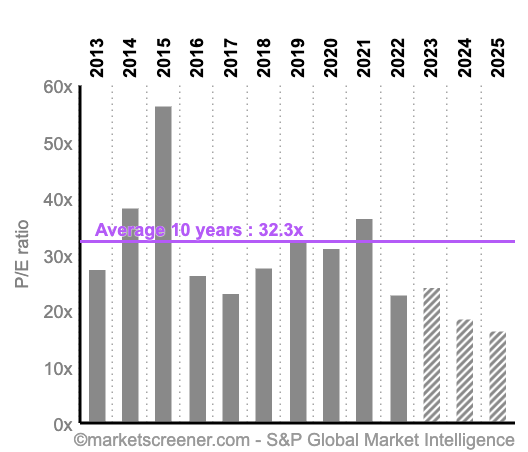

Notably, EXR's current price reflects a price-to-earnings (P/E) ratio of approximately 24x, which is below its 10-year average of 32.3x. This suggests a potential undervaluation relative to historical levels. It's worth highlighting that between 2009 and the beginning of 2022, the company exhibited a nearly flawless performance, characterized by consistent growth.

The acquisition of Life Storage by Extra Space Storage marks a strategic move that is expected to reignite the growth trajectory for the former. This acquisition brings several benefits, including improvements in cost structures and long-term advantages resulting from industry consolidation, particularly in terms of occupancy rates, pricing power, and avoiding overcapacity challenges. This development appears to be a mutually beneficial arrangement, creating a win-win-win situation for Extra Space Storage, Life Storage (reflected in the strong performance of LSI shares year-to-date), and the broader US self-storage industry.

Given that the deal is structured as an all-stock acquisition, it will increase Extra Space Storage's total payout obligations significantly. However, both entities boast robust cash flows, positioning the enlarged entity to effectively manage its financial commitments. This deal has the potential to substantially reshape the competitive landscape of the US self-storage industry, offering valuable insights into its future dynamics.

By

By