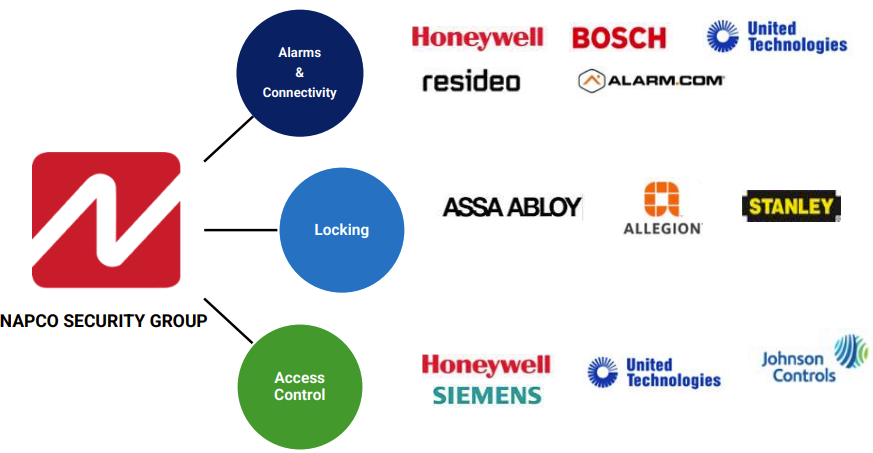

Napco is a leading manufacturer of security devices in three product families: intrusion, cellular and fire alarm systems; locking solutions; and access control tools, including integrated identity readers, control panels and various software solutions.

It is the most comprehensive player in the sector. Its main competitors are larger and operate in different business lines. Above all, Napco is the only one to be positioned in all three specialties.

Overview of main competitors (source: Investor Presentation)

Despite its modest size (less than $200 million in sales), Napco boasts a wealth of experience and a long history. The company was founded in 1969 and made its first major acquisition in 1987, that of Alarm Locks, which is still one of the group's four strong brands today.

Its success is based on an extremely efficient business model. In terms of production, 90% of products are manufactured at the plant in the Dominican Republic, a country with numerous tax advantages and low labor costs (only one tenth of the cost of similar labor in the USA). In this factory, The company is therefore able to produce both a secure door handle and a cutting-edge technological gadget. It's very efficient.

The three product ranges (source: Investor Presentation)

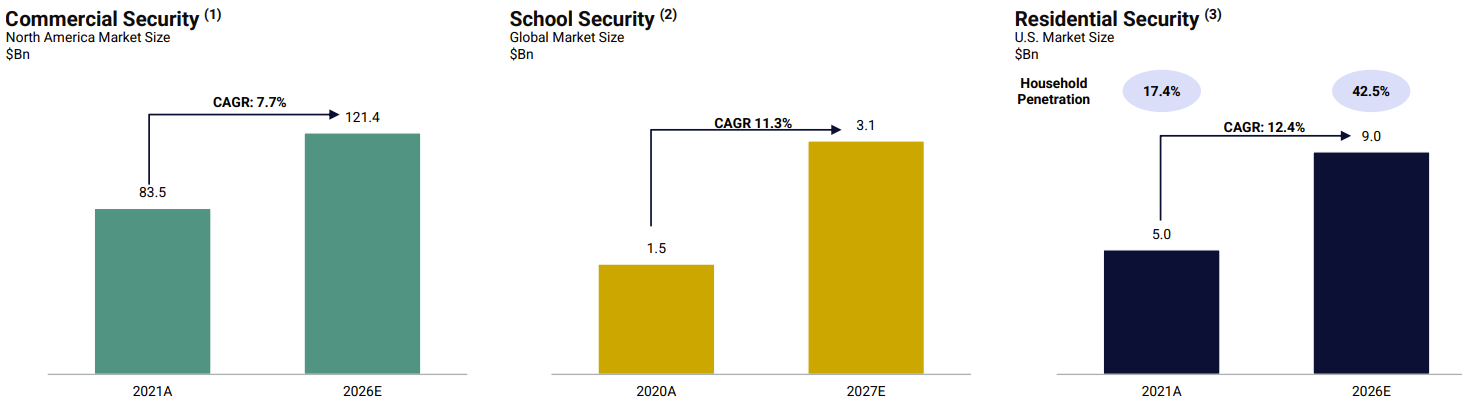

Napco sells its products through retail chains and independent retailers in the United States. They are used for a variety of purposes. The commercial building segment is currently the main focus. The residential market is also being exploited. In both cases, safety is a key concern. Strict standards must be met for both new buildings and renovations. For the future, Napco sees schools and places of worship as an even greater opportunity. In the United States, there are around 100,000 primary and secondary schools, 5,000 colleges and universities and 350,000 places of worship. Less than 10% of these institutions have adequate protection against an active shooter or intruder. State and local government budgets are increasing for this purpose. Napco has won several major school security contracts, including one for the Houston school district, the largest in Texas. On this project, the company is implementing access control solutions with intrusion, video and alarm communicators. This market could easily double by 2027.

Napco market trends (source: Annual Report)

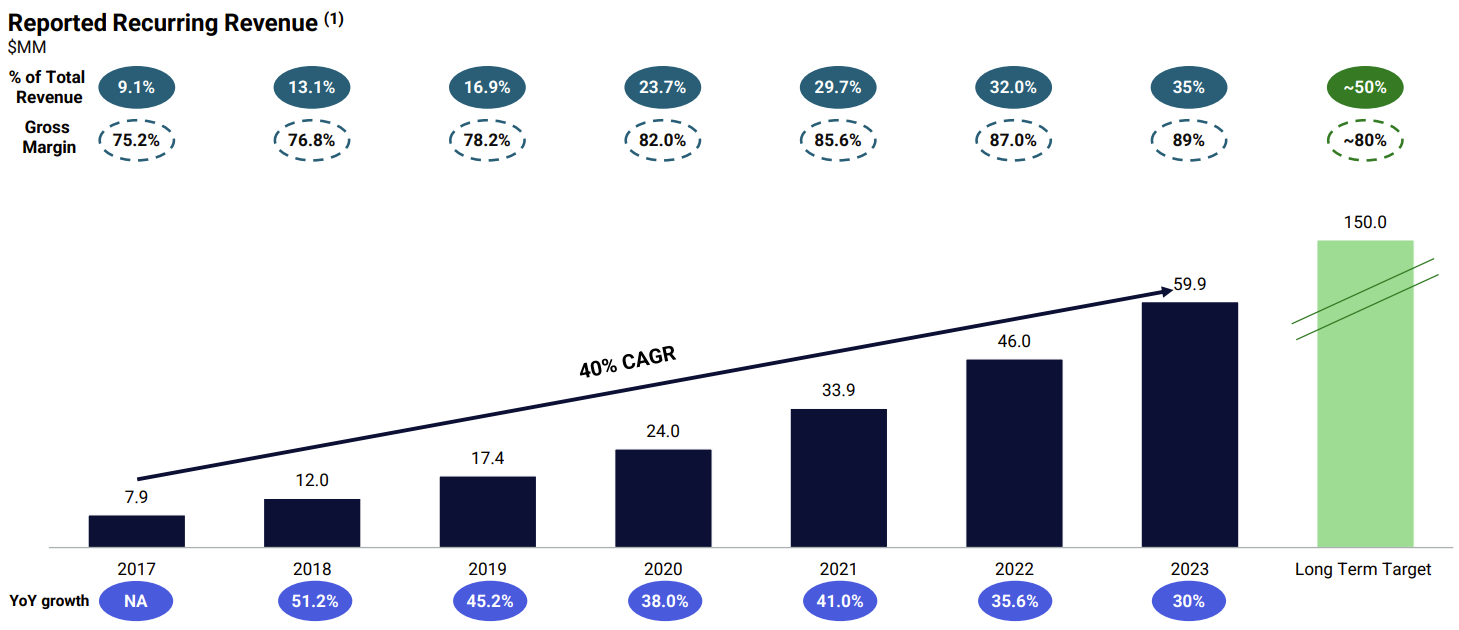

These good arguments are reflected in the accounts. 39% of total sales are recurrent. Napco has set up a system that encourages customers to pay a monthly fee for the use of communications services on certain equipment. This is particularly the case for alarm devices. Recurring revenues provide a steady stream of income, and are useful for mitigating the risks of fluctuating demand (due to the impact of interest rates that penalizing the residential market) and seasonality (the company's business is stronger before the summer, as professionals limit installation work during hot weather). Napco's long-term goal is to increase this share to 50% of total sales.

The phenomenal growth of recurring revenues (source: Napco)

Let's talk about sales. Napco has been experiencing dazzling growth for many years. Since 2015, sales have risen from $78 million to $170 million last year, representing a CAGR of 10.2%. Margins were equally buoyant. Net profitability rose to 16% last year from 6.2% in 2015. Analysts are still very optimistic for the coming years. The net margin is expected to be close to 30% in 2026.

The balance sheet is also very solid, as the company has no recourse to debt. Needs - particularly those for R&D, which oscillate between 5% and 8% of annual sales - are financed exclusively by cash flow. The trajectory of earnings per share (EPS) is also noteworthy, and is set to triple over the next 3 years.

Evolution of EPS. The next few years should be very lucrative (source: MarketScreener).

In terms of valuation, the stock remains rather attractive. Napco is on its all-time highs, but trades at 30 times earnings for this year, 26 times in 2025 and 18 times in 2026, against an average since 2015 of 37.5 times. Free cash flow yield (free cash flow / market capitalization) easily exceeds 3%. Despite the stock's exceptional track record, future earnings are only marginally valued. Visibility is good and all the indicators are in the green.

By

By