Solutions are delivered across the three main channels of digital advertising - ad search, social media and display/video/CTV advertising. It offers brands, publishers and advertising agencies the ability to reach their next customers wherever they are, through creative units orchestrated by its Intelligent Hub (iHUB). This digital hub brings together the company's commercial assets on both sides of the open web, offering significant advantages to brands in enhancing their visibility.

When a user browses through web pages or social networks, for example, Perion progressively places them in a funnel of sorts, offering consistent, on-the-fly coordinated content, layout and creative recommendations in a brand-safe environment. As soon as a user enters this funnel, Perion activates what they call an "intent score", which measures the progression from awareness to action. This score is determined by how consumers interact with the dynamic content, advertising and layouts to which they are exposed. Perion's added value lies here, in the way human nature reacts to stimuli and how AI technology instantly adapts to it.

Did you know that the average person is exposed to 15,000 advertising messages a day? In a world dominated by the quest for attention through stimuli, it's hard for a brand to break through the noise and emerge. The sites operated by Perion try to solve this problem by offering the most attractive content possible, so that consumers appreciate what they see. Perion's strength lies in its ability to capture and convince. For brands, this means lower acquisition costs and higher returns.

However, not everything is rosy for Perion, which has to contend with intense competition. The digital advertising sector is highly competitive. Many shooting stars have flashed across the sky in recent years, only to fade so quickly. The adtech world is changing fast, and many players have been rapidly overtaken. The risk of obsolescence is a constant threat to players in the sector, as technological advances are made at breakneck speed. There aren't many graveyards better stocked with fresh corpses than adtech.

In fact, Perion has come close twice. In 2015 with the reverse merger of ClientConnect and Perion (during which ClientConnect took control of Perion). And in 2017 after it reported an annual dry loss of $73 million. You only have to look at a chart of Perion Network's share price since its IPO in January 2014 to understand. A 94% drop in share price in four years, followed by an equally impressive recovery to the present day.

In addition to the risk of obsolescence, there's also a certain dependence on tech giants that can be quite dramatic in certain circumstances. The example of Apple, which changed its privacy rules in early 2022, immediately springs to mind. Finally, to conclude this symptomatic presentation of the risks, let's note that we've been observing an atrophy in advertising spending for some quarters now, after a decade of budgetary orgy. But let's not get too carried away, let's take a look at what Perion has up its sleeve.

Income statement

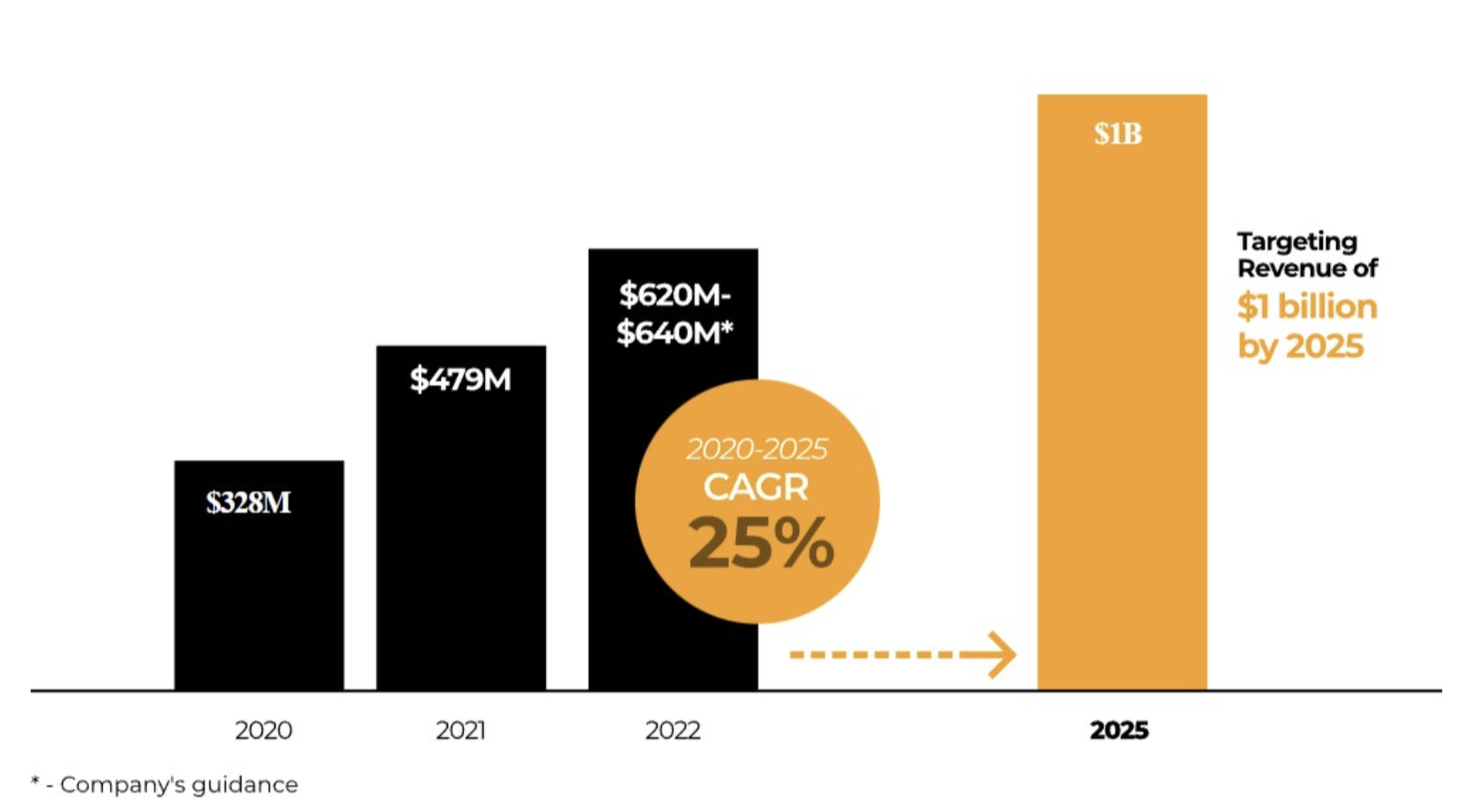

If we look at the financial statements from 2015 onwards (to be consistent with ClientConnect's reverse merger), we note that sales have risen from $259 million to $1.13 billion by 2022, representing a CAGR (compound annual growth rate) of over 20%. Well done! However, operating margin falls from 22.63% to 17.05% over the period, with a soft underbelly between 2017 and 2021 below 10%. Operating profit before impairment is rather erratic.

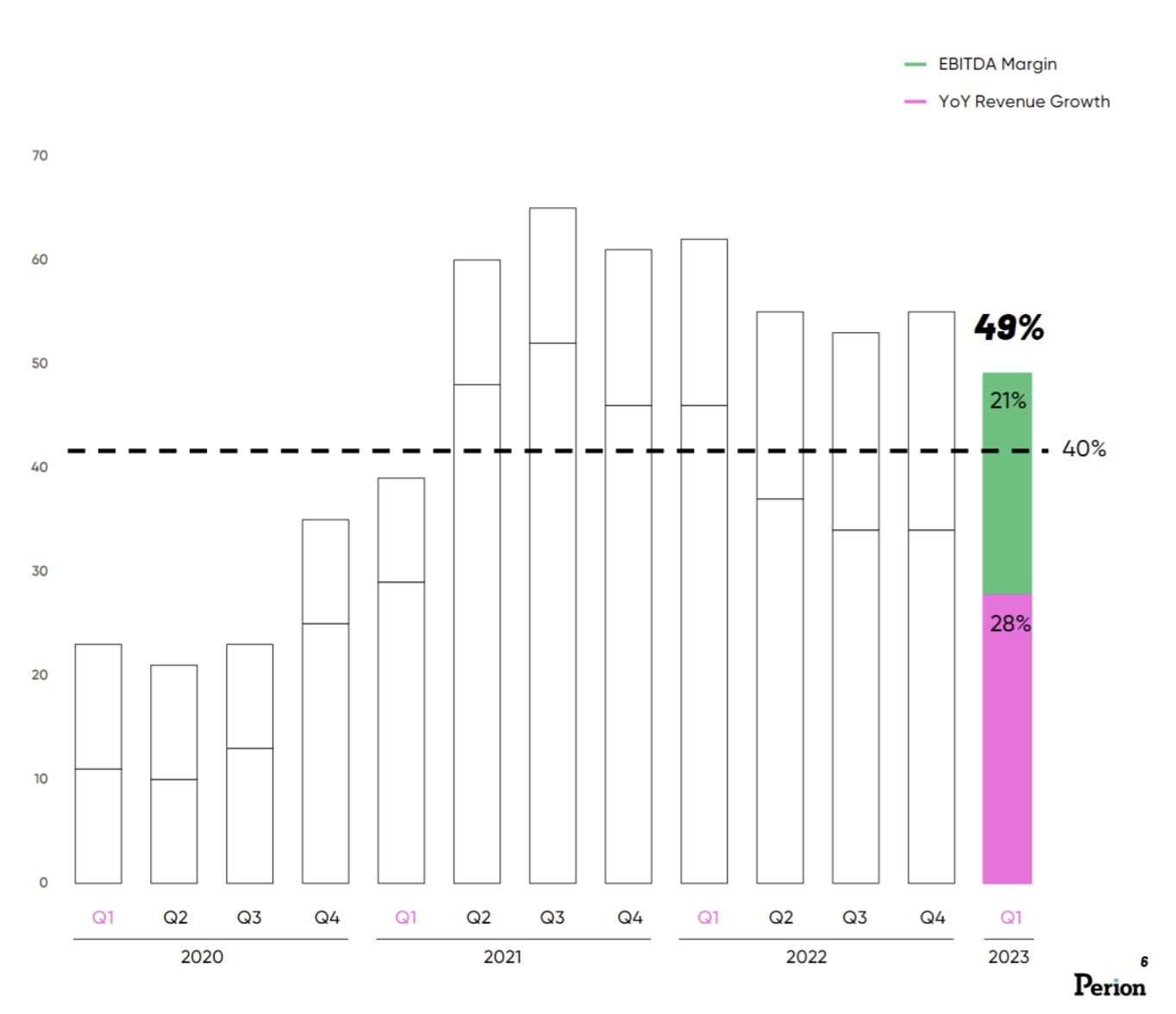

The Rule of 40 (YoY sales growth rate + EBITDA margin) has been respected for eight quarters, which is encouraging.

Source: Perion Network

The number of shares in circulation also increased over the period, from 22.76 to 44.66 million, with a capital increase in 2021 ($237 million raised during the operation, just before the online advertising market started to crack, so good timing on the part of management).

- Positive points: Significant growth.

- Negatives: Erratic profitability and shareholder dilution.

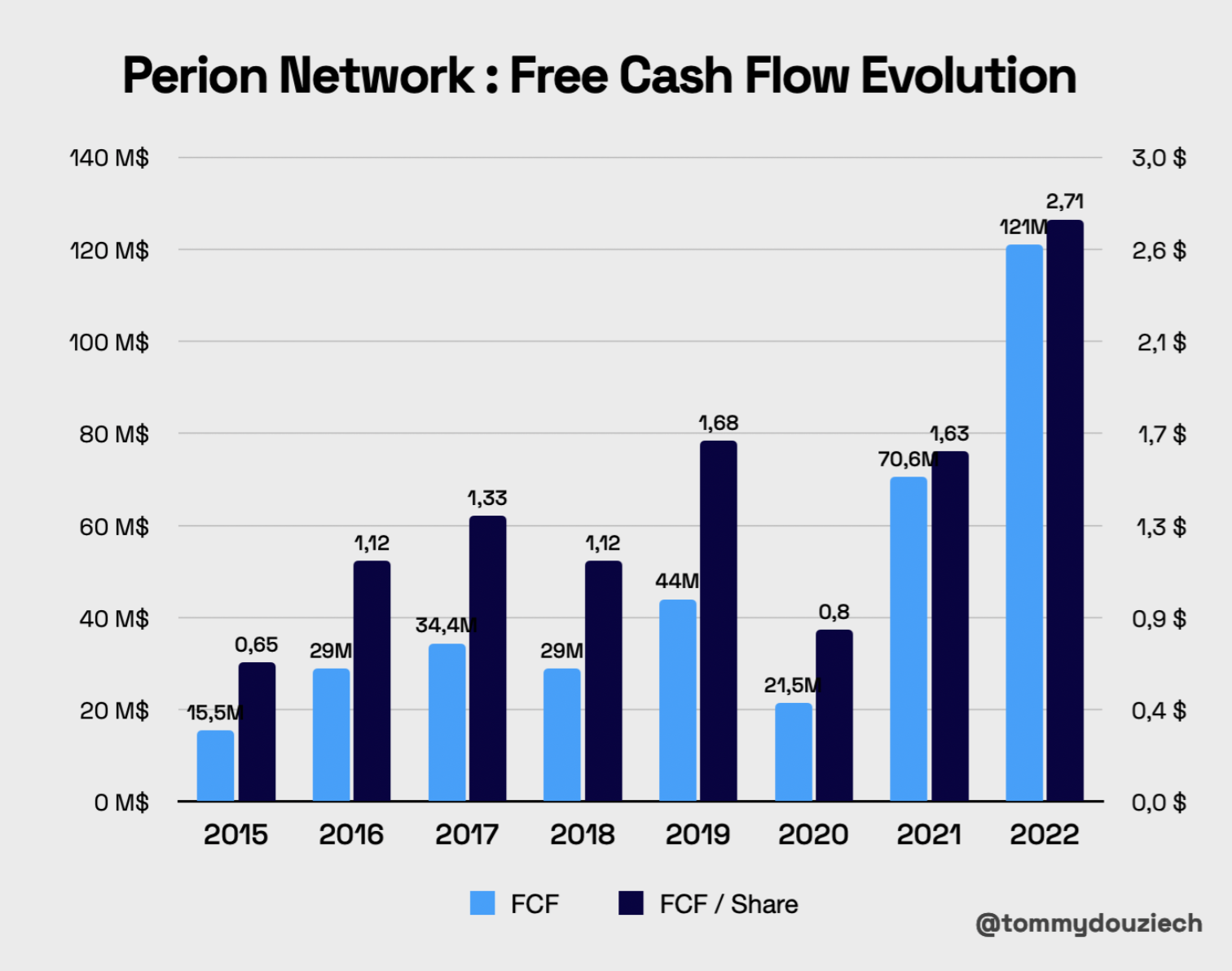

Cash flow

Okay, let's get on with it. It's all about cash, isn't it? Let's look at cash flow to understand what's really going on, especially as the accounting results have been impacted by heavy asset write-downs. We observe that Perion has taken out $365 million in cumulative Free Cash Flow (FCF) over the 2015-2022 period. We have not restated SBC (stock-based compensation) because there are not many of them.

FCF has been multiplied by more than 7 between 2015 and 2022. FCF per share multiplied by 4 over the same period. That's dazzling growth. But at this stage, it's hard to say whether we've had two exceptional years or whether we're just at the beginning of a great story. Given the lack of regularity in this growth, we remain cautious.

Over the past eight years, the vast majority of these profits have been channelled into acquisitions. This brings us to a potential red flag (to play devil's advocate), typical of the adtech sector and small tech companies in general: in fact, their longevity seems ephemeral and, as we said earlier, their solutions quickly become obsolete. As a result, they're constantly trying to reinvent themselves to keep up with the times, through acquisitions. In adtech, switching costs are very low, or even non-existent, so customers generally have no problem changing solutions. However, Perion is doing well, given the growth in its free cash flow. This means that the return on investment (ROI) on acquisitions is good, and that there is a strategic convergence leading to real value creation.

Balance sheet

As far as the balance sheet is concerned, we've done a good job of managing the business prudently enough to create value. After the capital increase in 2021, cash alone will cover almost 150% of total liabilities. The company has a good track record when it comes to external growth (as we saw earlier), so the pile of cash they have on their balance sheet is a real asset if they manage to deploy it intelligently in new M&A operations.

Valuation

The valuation is attractive, with a PER 2023 estimated at 15.9 times earnings at the time of writing. EV/EBITDA is 10.7x and FCF Yield is 6.65%. Clearly, not very expensive in view of growth and balance sheet quality. The question is why is it paying this price? Does the market think there's something fishy going on? It's true that the advertising sector is feeling the pinch at the moment. Let's take a look at the latest annual report.

What I observe: 37% of sales depend on Microsoft Bing, which represents a specific risk of customer concentration. Well, it's Microsoft, so that's reassuring, but ... Microsoft Bing, not the world leader, nor the best technology in Internet search. This explains the slight discount.

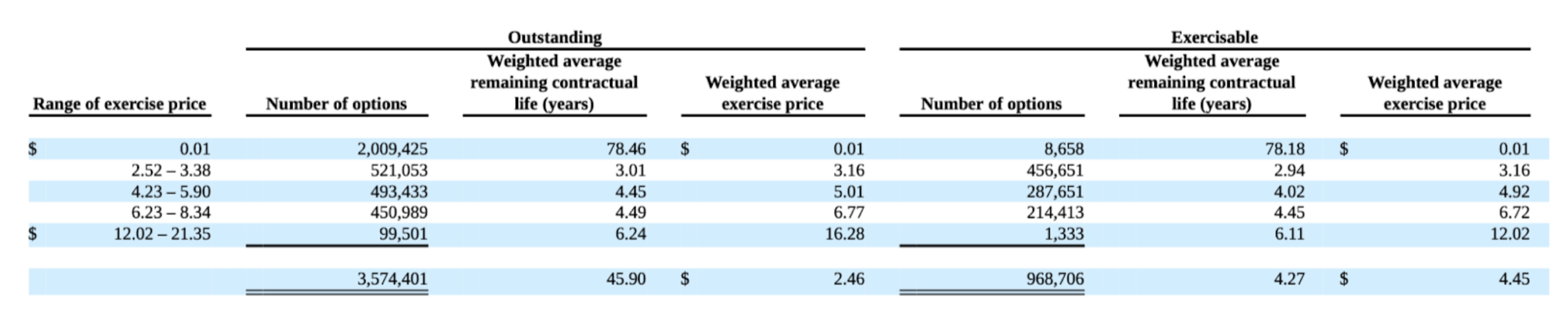

Compensation

In terms of SBC (stock-based compensation), as we've already mentioned, Perion's expenses are decent, and below what we traditionally see on the stock market in the tech sector. Still, we would have preferred a "skin in the game" approach to management. Here, management is not incentivized for performance; they'll always receive a big salary and SBC no matter what, and that's not necessarily reassuring for a long-term shareholder.

Source : Perion Network

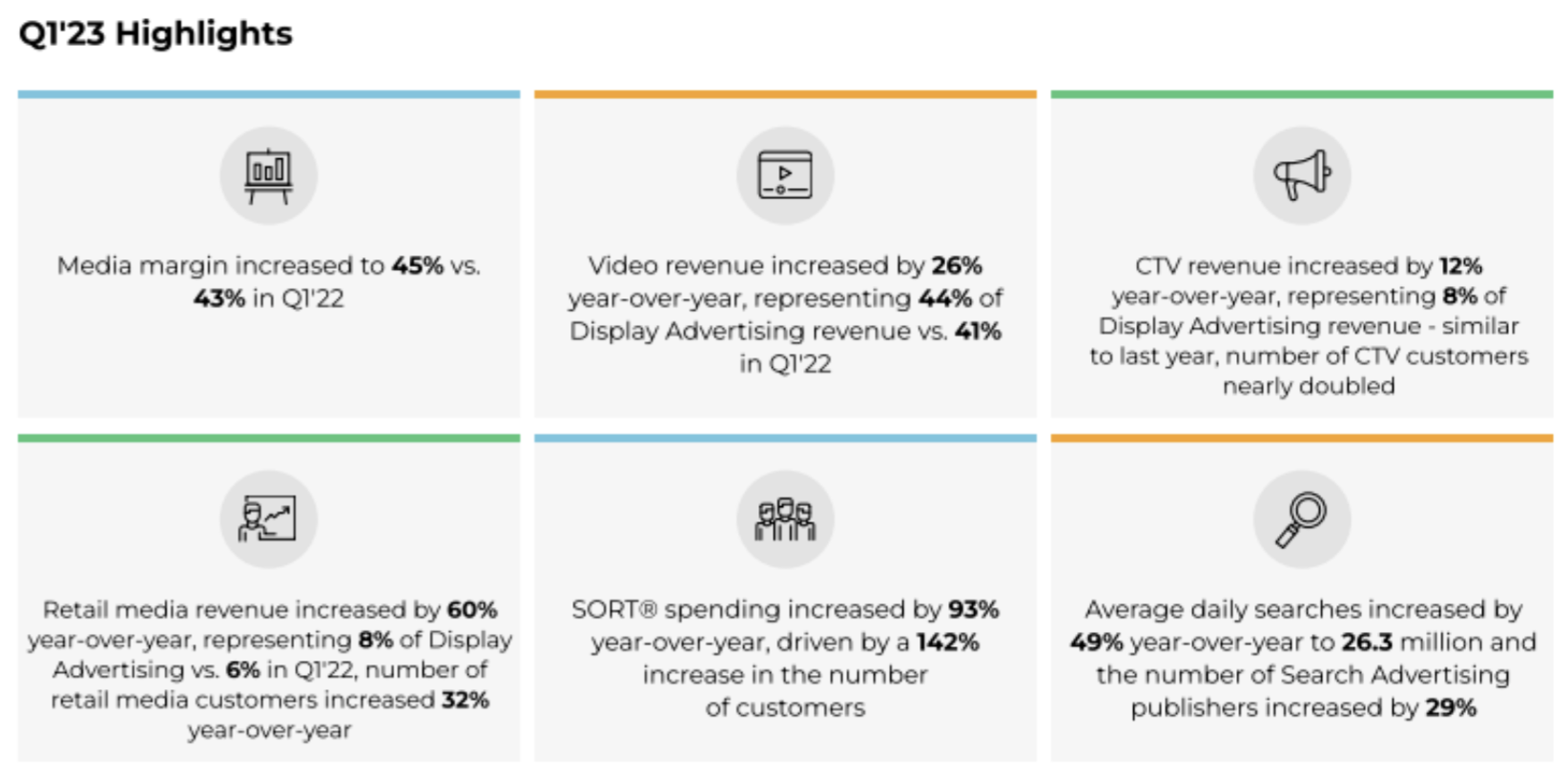

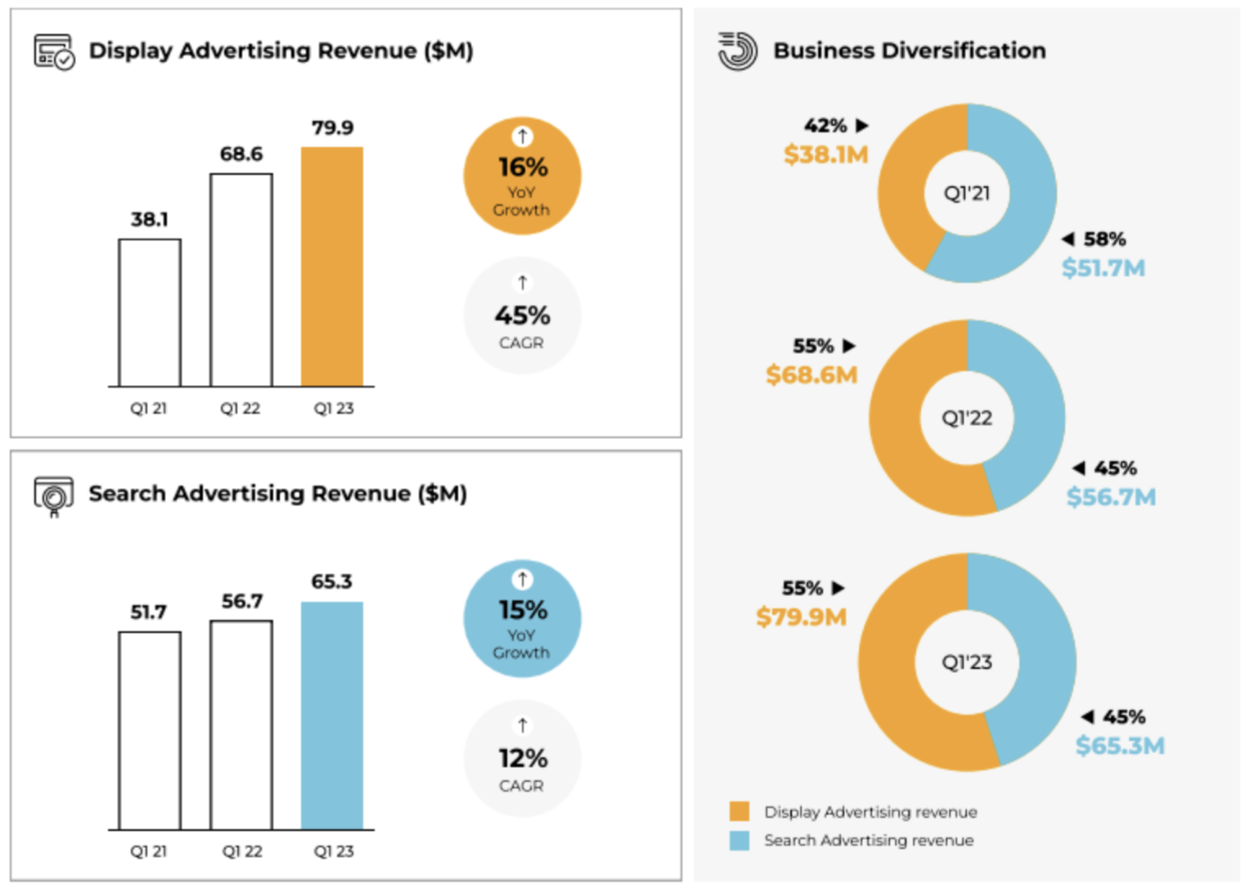

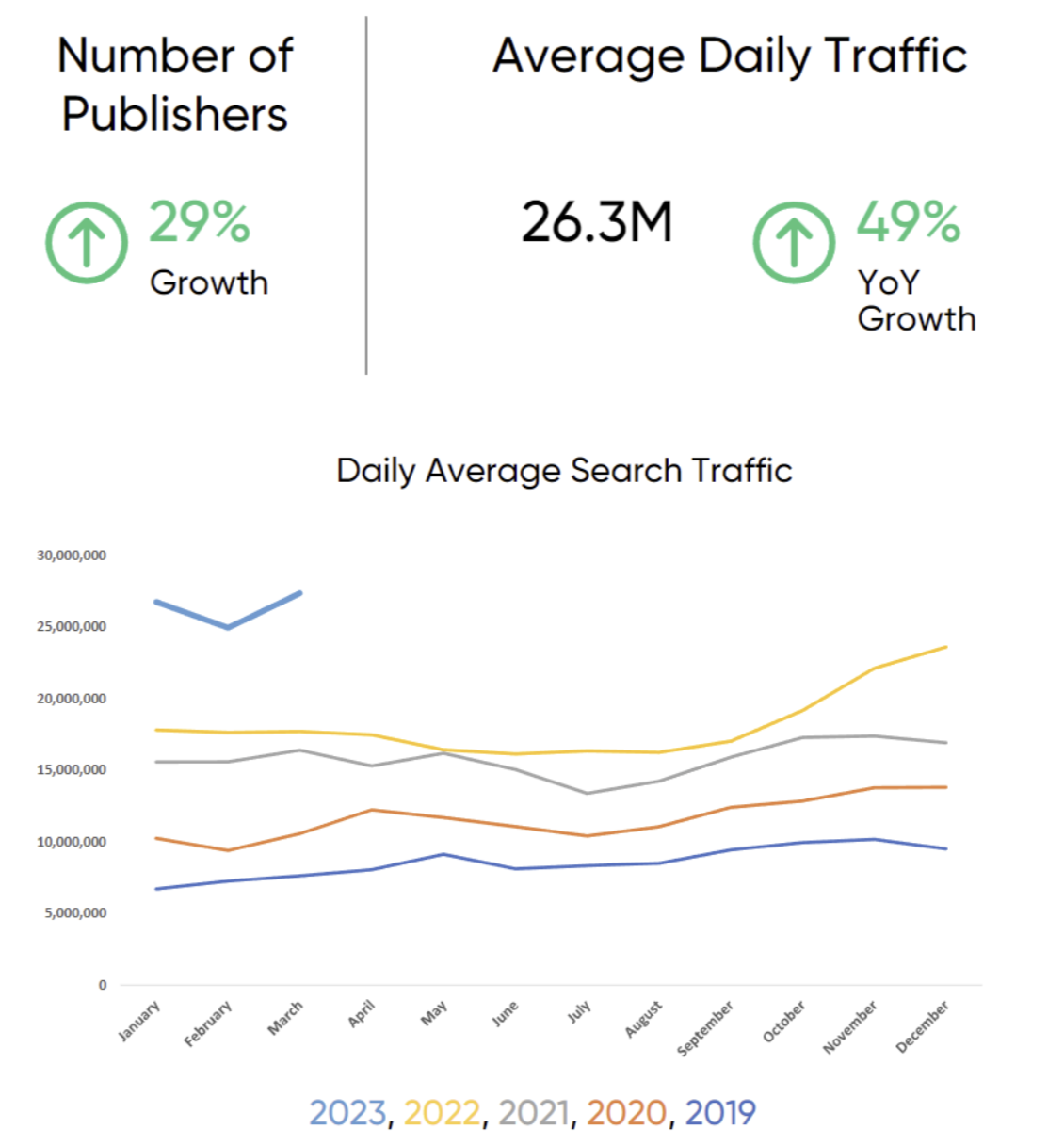

Perion Network has announced sales growth of 20% year-on-year and a 40% increase in adjusted EBITDA for the first quarter of 2023. Their growth outstrips that of their peers. The outlook is reassuring and tips the scales towards scenario #2, namely "we may be at the very beginning of a great story". I think a few images will better illustrate my point.

Source : Perion Network

Source : Perion Network

Source : Perion Network

Source: Perion Network

Overall, Perion is a fast-growing Israeli company with a solid balance sheet and a successful M&A track record. Their technology is innovative and gaining market share, even in the current gloomy advertising environment. However, profitability is volatile, the customer base is highly concentrated, the sector is highly competitive, EPS dilution is high, and management's financial interest is not aligned with shareholders' interests. Even if the stock represents a valuation opportunity and could make you money in the short-to-medium term, the risks are still high for a long-term shareholder.

By

By